Critical raw materials are those that are strategically important from an economic point of view and are characterized by a high risk of supply disruption.

To build wind turbines, electric vehicle batteries, electricity grids and other infrastructure needed for energy transmission, in addition to steel, cement, plastic and aluminum, five basic raw materials in particular are needed: lithium, cobalt, nickel, copper and neodymium.

the report Energy Technology Outlook 2023 The International Energy Agency (IEA) analyzes the current situation and future prospects, in light of the targets set by the net zero emissions scenario by 2050.

Estimated demand for important raw materials is growing faster than supply

To meet the targets set by the IEA’s net zero emissions scenario by 2030, the demand for each of the five base metals will increase by 1.5 to 7 times. To fulfill it would require a massive expansion of the mines. With the investments currently envisaged, mining in 2030 will still be well below demand. The largest gap between supply and demand concerns lithium. With the expected growth in extraction, two-thirds of the estimated needs for 2030 will be met. To close this gap, investments of about $360-450 billion will be required over the next three years.

In 2022, the number of exploratory drilling operations to find new mines to extract critical minerals from will quadruple compared to the previous year, although the speed with which the results will increase mining capacity is highly uncertain. In fact, it takes an average of seventeen years to open a new mine, including installing infrastructure, administrative procedures, and negotiating with local communities.

Nickel mining capacity has grown rapidly over the past year, largely due to the Indonesian government’s focus on this area. Indonesia has about a fifth of the world’s nickel reserves and attracts international investment from both mining companies and battery makers such as LG. Indonesia may be able to ramp up production quickly due to speeding up the bureaucratic process for obtaining permits. This has already doubled nickel mining between 2020 and 2022 and indicates that the gap between nickel supply and demand could be closed by 2030.

Critical Raw Materials: Treasure in the Hands of the Few

Production of critical minerals is highly concentrated geographically, which raises concerns about security of supply. The DRC now supplies 70% of the cobalt; China 60% rare earth elements (REE); and Indonesia 40% nickel. Australia accounts for 55% of lithium mining and Chile 25%.

Projected investments in the extraction of critical minerals indicate a modest overall improvement in geographic diversification of production in the coming years, but they vary across minerals.

Nickel production is set to remain firmly in Indonesia’s hands, with the country continuing to contribute nearly half of the world’s nickel production once ongoing projects are completed.

In the case of lithium mining, thanks mainly to the start of mining in Canada, the supply in 2030 will be a little more diversified than it is now, in fact, Australia and Chile will still account for about 70% of global production. Ongoing investment in cobalt mining is not expected to significantly affect geographic distribution, with DRC remaining by far the dominant producer.

Innovation and recycling will curb demand for critical raw materials

According to the International Energy Agency, more efficient use of materials will reduce demand for critical raw materials. A good example is cobalt: the mismatch between supply and demand is only 10%, and it is one of the lowest of the critical metals. This is made possible by innovations over the past five years that have lowered the cobalt content in batteries. Substitution of materials also plays an important role. For example, perovskite-based photovoltaic technologies can reduce the demand for polysilicon, which is currently in high demand for production in photovoltaics.

An important role is also covered by recycling and the production of secondary raw materials. For some metals, collection rates for recycling are high, such as 60% still nickel, while for other metals there is still plenty of room for improvement, such as 46% still copper and 32% still cobalt. Conversely, recycling rates are very low for those critical materials that have recently begun to be widely used and which have a low concentration in final products. For example, lithium and rare earths have recycling rates of less than 1%, mainly for two reasons: on the one hand, their low concentration in finished products makes recovery more expensive, and on the other hand, the recycling sector has had little time to develop processes and appropriate infrastructure.

The rapid growth in demand for biomaterials is very recent, so a significant increase in the production of secondary raw materials is not expected until after 2030, when the primary materials used from 2020 for the production of vehicles and devices will become available for recycling. For example, the International Energy Agency projects that secondary production of lithium will grow from negligible amounts today to nearly 35% in 2050. To understand the impact of recycling on mining, just keep in mind that if lithium recycling rates stay the same as they are today, Mining capacity is projected to increase thirteen-fold by 2050, but thanks to increased recycling rates of lithium, only an eight-fold increase is sufficient.

Improving recyclability is a key part and innovation will be important, both to improve the efficiency of recycling methods, even if recycling processes are already well established for widely used critical materials such as copper and nickel, and to design products that are easier to use. Recycling. For example, copper in cables, electronic devices, and larger products is relatively easy to separate for recycling, while recovering lithium from batteries is much more difficult. Better product design can also reduce the amount of raw materials needed; For example, cars with lighter designs require less materials for both the body and the engines.

Reusing products also contributes to reducing the demand for raw materials, for example, electric car batteries can be reused in electricity storage stations.

Figure 1. Evolution of demand for critical raw materials divided by type of end use in the IEA’s net zero emissions scenario by 2050.

EU policy on important raw materials

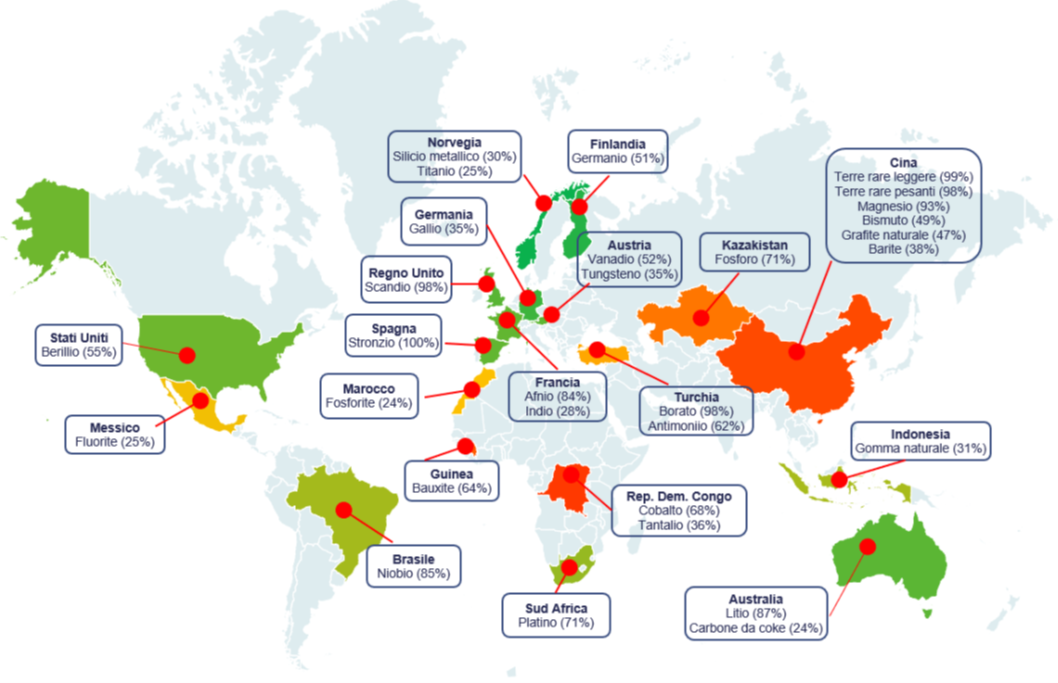

According to another reports Implemented by Cassa Depositi e Prestiti (CdP), the countries of the European Union depend more than 80% on imports of important raw materials. Thus, European industry runs the risk of not only being able to pursue leadership in strategic supply chains for environmental and digital transformation, but also the ability to achieve the goals of the Green Deal and the Digital Compass.

Figure 2: Concentration of EU supplies of important raw materials. The percentage indicates the EU needs satisfied by that country, while the color indicates the geopolitical risks associated with the country itself. Geopolitical risks are estimated on the basis of the Democracy Index and expressed on a scale from 0 (red) to 10 (green), where 0-4 is the range containing authoritarian regimes, 4-6 are hybrid regimes, 6-8 are incomplete democracies and 8- 10 perfect democracies. Source: “Environmental and Digital Transformation Brief: Point on Critical Raw Materials” published by Cassa Depositi e Prestiti.

To achieve climate neutrality, the European Commission estimates that by 2050 the EU’s annual demand for lithium could increase by 56 times compared to current levels, for cobalt by 15 times and for rare earths by 10 times.

As the CdP report explains: “In the current context of fragile international balances, the European Union is exposed to potential disruptions in the supply of important raw materials due to limited internal production and dependence on supplies from countries characterized by high geopolitical risks and sensitive trade and diplomatic relations with the West.” Indeed, for the past few years Europe has had to contend with trade tensions between the US and China, disruptions to supply chains due to the pandemic first and then the invasion of Ukraine.

Important help to mitigate the mismatch between supply and demand can come from the circular economy; By 2040, thanks to battery recycling from electric mobility, the EU could meet 52% of the demand for lithium and 58% for cobalt. To enhance the production of secondary raw materials, it is necessary to exploit “urban mines”, that is, to promote the collection, recovery and recycling of waste electrical and electronic equipment (WEEE), batteries and accumulators.

However, recycling alone is not enough to guarantee the EU’s independence. According to the report, therefore, to mitigate supply risks, it is necessary to invest in technologies, skills and competencies to manage the life cycle of important raw materials within the borders of the European Union but also to relaunch mining activities in a sustainable key to the territory’s society. Recently, thanks to sustainable mineral exploration technologies, deposits of rare earths have been discovered in Sweden, the reserves of which are more than 1 million tons. Another important aspect relates to the development of strategic partnerships that enhance trade relations with third countries rich in important raw materials. In this sense, the EU has already initiated many bilateral dialogues and is already participating in many international tables focusing on important raw materials. In particular, the EU could benefit from agreements already concluded between 2021 and 2022 with Canada, Ukraine, Kazakhstan and Namibia.

The topic is at the center of the European debate and should lead, in March, to the promulgation of the European Critical Raw Materials Act, which focuses precisely on diversifying supplies and promoting circulation. For some Rumors spread These days, one of the measures envisaged would be the creation of a centralized procurement agency for critical raw materials and a payment to member states to speed up the process of licensing new mines.

“Infuriatingly humble social media buff. Twitter advocate. Writer. Internet nerd.”

.png)