As much as the IRA is a climate law, it is still industrial policy. It provides financial support for the entire clean energy value chain – from materials to production and deployment – with the aim of developing local supply chains and reducing dependence on China. For this reason, national rules regarding tax exemptions are an essential feature of the law. A clear and workable credit framework has shifted attention to the US dramatically, drawing clean energy investment and directing capital away from the European Union.

Since the introduction of the IRA, the European Union has expressed concern about two main risks: diversion of productive investment and investment in enterprise development. These possibilities were realized when several European industries announced plans to expand into the United States. For example, Volkswagen decided to prioritize the development of a battery plant located in the United States rather than in Eastern Europe. And so, in the first quarter of 2023, the EU responded to the IRA by announcing the Industrial Green Deal plan. The plan is not revolutionary but evolutionary, as it represents an acceleration of European policies on the subject, in order to remain competitive in the clean energy sector in the post-IRA era. The European plan includes two acts: the Net Zero Industry Act and the Critical Substances Act, which set the goal of increasing national production capacities for eight strategic zero-emission technologies, so that by 2030 at least 40% of demand will be supplied by itself and 40% of the necessary minerals will be processed within the Union.

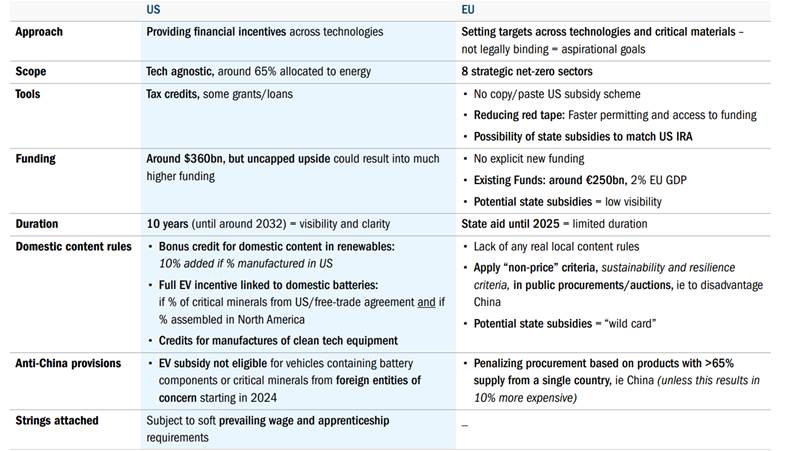

The objectives are important but not binding and are proposed to be achieved by reducing bureaucracy, facilitating current funding and shortening licensing processes. While the plan does not include a Europe-wide group support system similar to an IRA, it does propose a temporary relaxation of state aid rules for EU countries to allow them to introduce a support tax potentially equivalent to IRA benefits. This undoubtedly represents a crucial signal that the EU is determined to compete for green industries, although at present the methods of effective implementation in individual countries remain uncertain (Fig. 1). Therefore, we believe that the simplicity and clarity of the IRA are likely to be the key factors in investment decision-making in a scenario where the US comes into conflict with the EU, thus reducing support in the EU.

Figure 1 Two competing approaches

Main focus of the US IRA and the European Green Industrial Plan

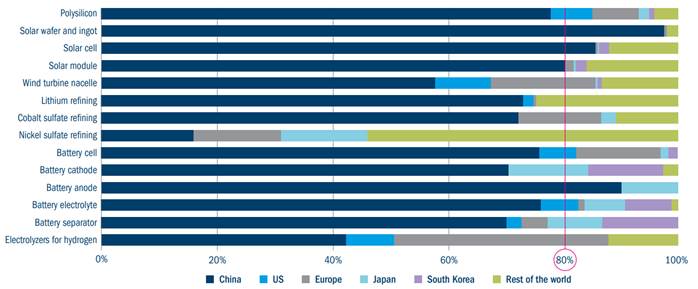

Although the two policies have different approaches and tools, they share one goal: to increase the production capacity of clean technologies at the national level, and thus reduce over-reliance on China. Indeed, the energy transition is a challenge for the supply chain. Only a small amount of production is in the US or the EU currently, while production in the main sectors of the energy transition (solar, wind, and battery production) is dominated by China with more than 80% of global capacity (Fig. 2). Therefore, the common goal of the United States and the European Union to support national supply chains through the development of domestic production will be difficult and costly.

Figure 2: Supply chain in the clean energy sector

direct consequences

The combination of IRAs and the Green Deal should result in benefits for industries in the clean energy value chain, especially those with global exposure in both regions. The unlimited nature of the IRA’s tax breaks means the amount of investable capital could significantly exceed the $370 billion initially envisioned in the plan, with Goldman Sachs and Credit Suisse estimating about $1.5 trillion in investments in the plan. next decade.

Meanwhile, despite the fact that the Green Deal does not foresee new funding, the EU says it has around €250 billion in RePowerEU funds available to spend. This number would be small compared to the estimated $1 trillion annual investment required in the European Union. However, faster access to funds, along with looser rules on applying for state aid at the national level, could be key to unlocking private capital. The success of the green industrial plan also lies in its implementation by the member states, which makes it difficult to assess its impact. A broader and faster policy response could stimulate investor interest and provide more support for European companies. In particular, companies with greater exposure to Germany within the EU could benefit more, given Germany’s financial flexibility in providing subsidies and the drive to compete for capital allocation.

Sectors that can benefit most from the dual dynamics of the United States and the European Union include:

- renewable energy generatorsAmong the clear winners are those companies where wind and solar energy are already competitive even without subsidies and are located in regions, such as Iberia, Germany and the United States, where there will be capital mobilization and strong growth for renewables. In this context, an IRA and a green deal are pluses.

- Integrated operators of the gas industrywhere they will benefit from the wider adoption of blue and green hydrogen.

- pure hydrogen producers and electrolyzers, Especially companies with a strong global presence that already generate a significant portion of their revenue in the United States.

- Active producers in the renewable energy sectorsuch as manufacturers of wind turbines, solar panels and batteries, which will see very positive impacts given the support of national supply chains.

- Mining / metal recyclingMiners and processors exposed to the expansion of critical materials in the European region should benefit from streamlined licensing processes and government funding.

- Industries exposed to the renewable energy value chain: The leap forward in the field of renewable energy will increase the demand from those companies that in the value chain produce differentiated products to generate. The significance and timing of the impact on earnings will vary between companies, but companies involved in electrical equipment, mining, and energy efficiency will undoubtedly have a positive impact.

Widespread implications and future prospects

The dynamics of the IRA and the Green Deal are clearly driving inward sourcing and greater diversification of supply chains. A more fragmented global market – including European domestic markets – will generate new considerations and weights by investors and companies. The goal of avoiding over-reliance on China while remaining competitive will be difficult. Redistribution of critical inputs could limit the ability of some industries to grow, while challenges related to sourcing raw materials and expanding manufacturing facilities could have unintended consequences. For example, to build diversified and local supply chains, procurement needs will become a strategic priority for companies: long-term partnerships, targeted acquisitions, and vertical integration can be key factors for securing raw materials. In particular, we may increasingly see similar initiatives from OEMs to secure access to raw materials, and from renewable energy developers to work with suppliers to build additional production capacity or invest directly in vertical integration. This could include outsourcing critical components, expanding manufacturing facilities, or building new ones.

Intense competition in battery or renewable energy supply chains could be detrimental to companies in these sectors, as well as potentially leading to greater price volatility of key clean energy components and raw materials. Correspondingly, there is a risk of a further energy inflationary shift: producing many components domestically and supplying many materials vital to clean technologies could be costly and inefficient, and thus more expensive than the current import from China. With solar energy, in particular, there is a risk of oversupply. The United States and the European Union are not the only ones trying to boost domestic production; India also provides subsidies, and China itself has plans to expand production across the entire supply chain much faster than other countries. The International Energy Agency (IEA) predicts that this will lead to a significant energy glut by 2027, with solar power supply significantly in excess of projected global demand. The result will be a capacity utilization level of 25% to 30% in China for all manufacturing sectors, about half the current level. This glut may also create intense price competition and prompt investors to cancel several announced expansion projects inside and outside China. Other unintended consequences may be local requirements and limited availability of materials that promote acceleration of the circular economy/recycling to reduce resource consumption, for example greater emphasis on battery and metal recycling; Growth of new technologies/stimulus for innovation (eg the EU does not produce lithium, so battery manufacturers will have incentives to continue to innovate sodium-ion batteries produced without lithium).

What does all this mean in geopolitical terms? The elephant in the room is China’s answer. Given that both the US IRA and the European Green Deal could hurt Chinese cleantech players to the benefit of the US and the EU, retaliation from China is not far off. So there is a risk of an increase in global trade tensions. The flip side, however, is the emergence of “friend support,” as the US expands its trade deals elsewhere, benefiting companies from Japan, Korea, Chile, and Australia — and perhaps even the European Union. – among others. We will follow developments with great interest.

“Prone to fits of apathy. Introvert. Award-winning internet evangelist. Extreme beer expert.”