By Jeffrey Smith and Alessandro Albano

Investing.com – Pfizer (NYSE 🙂 offers a new treatment against Govt Modern The stock market slumped again. Meanwhile, cases are on the rise in Europe, especially among the unvaccinated population, while the credit crunch in the real estate market in China continues after another company was suspended from the Hong Kong stock market. In the United States, a few days after the Federal Reserve’s announcement that the indices are heading for new highs, the labor market is showing signs of a strong recovery, with European stock markets preparing to close in broad positive territory for the first week of November. Here are the major market moves this Friday:

1. Europe likes Govt again

The World Health Organization (WHO) has warned that 500,000 deaths from covid-19 will occur in the European region (including Russia) this winter, with infection rates and hospitalizations continuing to rise across much of the continent.

There is a consistent high level of immunization behind the season, the first wave of vaccines, the decline in immunity and, above all, the latest wave dominated by delta variation. New infections and population-related deaths are higher in Eastern Europe, where vaccination rates are also lower. In Russia, for example, deaths are more than 1,100 a day and new infections are 40% higher than last winter’s peak.

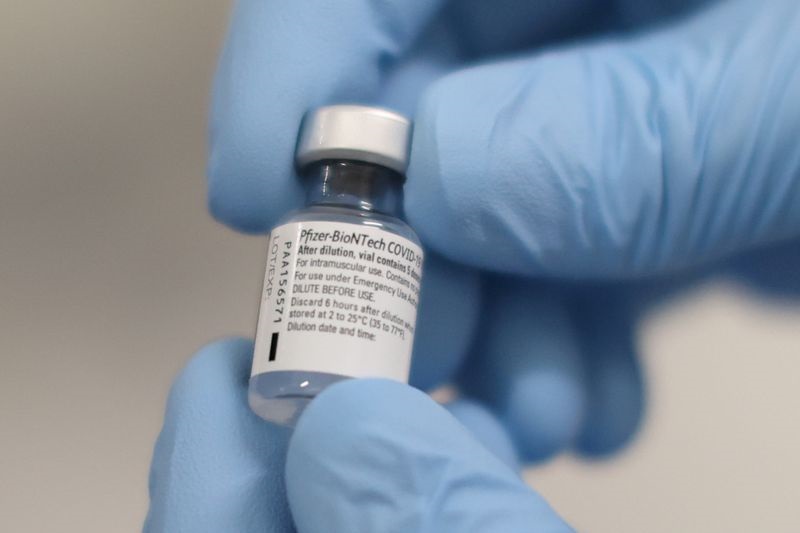

2. New drug against Govt

Pfizer (NYSE 🙂 PAXLOVID, also known as PAXLOVID, flows into the pre-market after announcing a new antiviral treatment against goitre today, which may be effective against delta variation and others in circulation, according to research.

According to “intermediate” phase 2/3 analyzes, the new pill “significantly reduces the number of hospitalizations and deaths of adult patients who are not hospitalized with covid disease, and they are at risk of progressing to serious illness”.

Analysis, explains great medicine In the spread note, Showed an “89% reduction in the risk of hospital admission or death due to Govt-related cause compared to placebo for patients treated within three days of the onset of symptoms”.

News of Pfizer’s new tablet has had a bad effect on other vaccine players, with Moderna (NASDAQ 🙂 losing 12% of the previous market after yesterday’s crash (-17%).

3. The labor market is growing United States

The U.S. fell to 4.6% in October, the lowest level since March 2020 and slightly below market expectations of 4.7%.

The most anticipated data for the NFP is that the US economy added 531,000 jobs last month (three-month highs), surpassing market forecasts of 450,000. The most significant increases were recorded in leisure and hospitality (164K), professional and corporate services (100K), manufacturing (60K) and transport (54K).

From January to October, monthly employment growth averaged 582k, while non-agricultural sector employment increased from a low of 18.2 million in April 2020, but fell to 4.2 million compared to the pre-epidemic level.

4. Bags

Wall Street is expected to end at a new all-time high following assurances given by Federal Reserve Chairman Jerome Powell on the pace of interest rate hikes.

I’m up 113 points, I’m up +18 points and +43 points. On the other hand, be wary of Uber (NYSE 🙂

In Europe, the pink jersey (+ 1.1%), driven by quarterly reports and corporate news, rose 0.3%, + 0.9% and + 0.9%, respectively.

5. Effect Evergrande In China

Kaisa Group Holdings (HK :), one of the leading Chinese real estate operators, was suspended from the Hong Kong Stock Exchange for failing to pay for a product reserved for customers in the Wealth Management Division, while China was dragged down by securities and securities with Evergrande. (HK 🙂 decreased by 2.5% and -1.4%.

According to China’s Economic Observer, the company’s stock market fell 15% on Thursday to CNY12.8 billion (approximately $ 2 billion) in interest on capital and wealth, compared to the larger Evergradande. But that is enough to exacerbate the “debt crisis” that is destroying Chinese real estate.

“Prone to fits of apathy. Introvert. Award-winning internet evangelist. Extreme beer expert.”