Auto Stamp is one of those taxes that usually cannot be avoided when owning a car or motorcycle. This is because it is specifically the car ownership tax. But there are exceptions in certain cases.

The car tax Usually it must be paid within 30 days of purchasing a new car. Not only the month of purchase is important, in fact you can pay the car tax even within the month following registration. Specifically, when the car was registered in the last ten days of the month. This is a regional tax All are Italian. In the United States, for example, it does not exist, and it is no coincidence that it is easy to switch from one car to another and it is common for one person to own several cars.

However, there are instances where an exemption can be obtained, and they are differentiated depending on the individual who will be driving and the vehicle. In principle, the first category relates to people who have to drive a car, whether it is owned by them or not (it doesn’t always matter if they own it but they have to drive it).

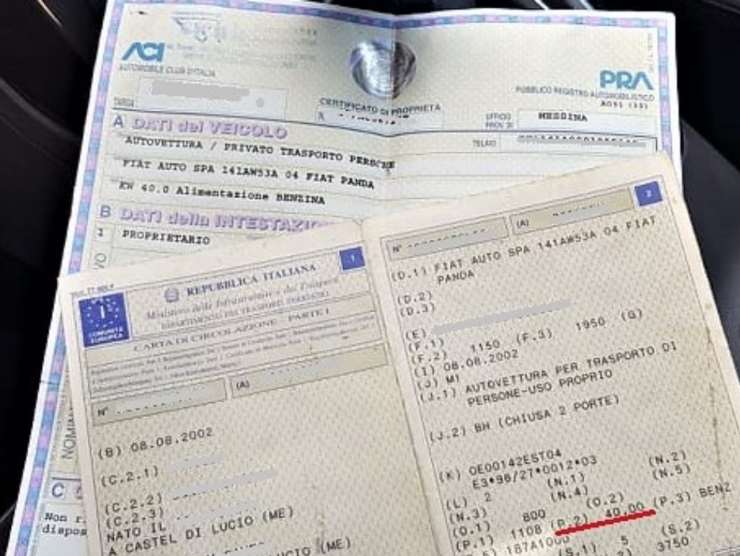

The second category, on the other hand, is vehicle specific. Anticipating what we will explain in detail below, you get an exemption for non-polluting vehicles and older vehicles. But how do you know that our car falls into the exemption states? We’ll explain it to you right away.

When stamps are not paid

In detail, although it is a regional tax, there is a national law that regulates the exemption from paying motor vehicle tax. Basically, there is an exemption from paying car tax Law holders 104.

Vehicle tax is included in exemptions for the disabled but certain conditions must be respected. Certainly, it includes people with mental disabilities who carry an accompanying benefit. It is not necessary for them to drive a car (also because they are often not qualified to do so), but they can still have a car designated for personal escort. In this case, the value of the vehicle tax is deducted.

Then we find, among the beneficiaries, all those who have a walking limitation, or have low or handicapped motor skills. In this case, whether the circumstances in question allow the vehicle to be driven (eg with an automatic gearbox or behind the wheel), or if this is not possible, the full exemption will apply. Even in the case of vehicles designated to accompany people who are deaf or blind.

It is essential that the vehicle in question is well-equipped At least one of the tricks Provided for the purpose of Ministry Transport. We are always talking about: a lifting platform with a mechanical, electric or hydraulic drive; With the same drive, also the retractable slide, lever, lever. It must also contain: a movable or sliding seat at one time; Wheelchair restraint system with proportional restraint system, such as seat belts; Finally, one or more sliding doors.

Even if the owner of the car is the person with a disability Taxable PersonIn any case, an application can be made for the respective benefits related to the vehicle tax.

In this regard, it is good to remember that the subject is legally dependent on taxes if his annual income does not exceed the 2840.51 euro limit. In this amount, according to the legal prescription, welfare benefits are not included. In practice, pensions, allowances and allowances for the disabled civilians.

There are also properties related to displacement and force. For gasoline vehicles, the displacement should not exceed 2000 cc, and not more than 2800 in the case of hybrid or diesel vehicles. In the case of an electric motor, there is a power of 150 kilowatts that the device cannot exceed. The exemption is also valid in the event that there is a car in the name of a family member on whom the financially disabled person is dependent.

Exemption for unpolluted, old or old cars

The second case of exemption from paying road tax relates to the vehicle itself. In this large class we can distinguish two main ramifications: Non-polluting electric vehicles and vintage or historic vehicles.

In the first case, road tax is deducted for the first 5 years of car ownership, while the tax for the remaining years is reduced by 75%. It is not a valid rule everywhere because it is a regional decision, so it is advisable to inquire on the website for your region.

An exemption can also be obtained for vintage or historic cars, as long as they are not used for professional purposes. In particular, a vehicle over twenty years old is entitled to a 50% discount, while if it is over 30 years old, it is actually old and is entitled to a full exemption.

“Infuriatingly humble social media buff. Twitter advocate. Writer. Internet nerd.”