According to the Agenzia delle Entrate agency, debts attributed to a person are forfeited upon their death. But what are these debts?

according to applicable standards by the Revenue AgencyThere is a risk of debt default under certain circumstances.

We often discuss an issue Outstanding amounts that accumulate over the course of a person’s life.

Usually, these amounts are included as part of the next person’s estate and inheritance passed to the heirs after their death.

We often encounter situations where these sums require careful handling and consideration.

How to check debt with a revenue agency

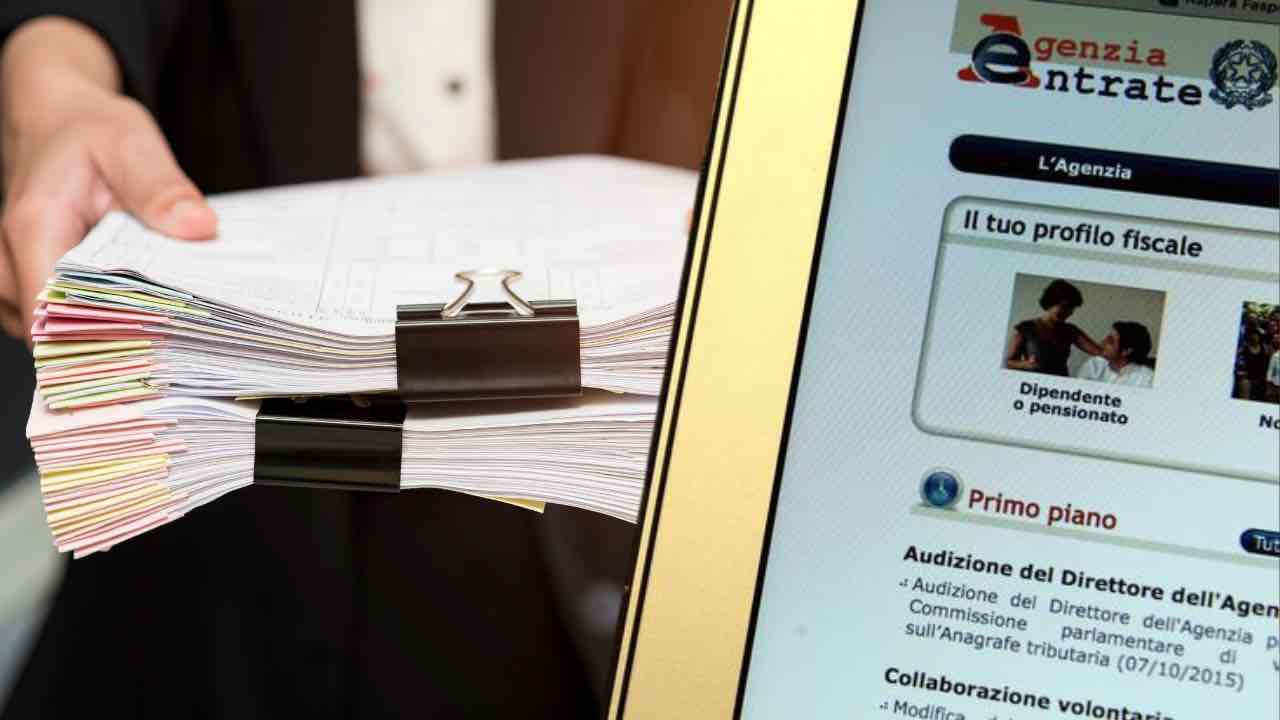

If you are unsure of your tax debt or have concerns about any unpaid taxes or bills that may have been incurred in your name, The official portal of the Revenue Agency The situation can be clarified with taxes. Using this resource can be invaluable in such situations.

To confirm whether there is an outstanding debt against the treasuryIndividuals can obtain a statement of debt account directly from the Revenue Agency through its online portal.

By accessing the Revenue Agency’s web platform with unique personal credentials, each citizen can check their own tax statusincluding any late payments owed to the tax authorities, such as past taxes, fines or motor vehicle tax.

Thanks to the Agenzia delle Entrate online portal, checking the status of your debts is an easy process.

By doing so, you can continue Pay any overdue debts which are not properly connected for various reasons.

Pre-checking whether or not there are tax debts can prevent the tax authorities from taking action forced combinationsuch as attaching or sending a tax collection notice

In addition, you can request a more manageable debt repayment plan within certain timelines, such as paying in installments.

Usually, in the event of non-payment of debts, tax bills are delivered directly to the citizen’s home. Accompanied by a ruff Which can be paid at the bank or at the post office.

If you are staying abroad, payments can also be made via bank transfer or home banking.

However, there may be circumstances where a tax bill It is mistakenly sent to the debtor’s old address, leaving him unaware of the existence of the debt.

However, if payment is not made, financial management However, interest and related penalties will be charged on the debt until it is amortized.

When debts expire at the time of death

It is usually the responsibility of the designated heirs to determine whether or not to bear the debts owed by the deceased as directed. in the will.

By law, in order to receive all of the inherited estates, the heirs must also inherit outstanding debts. Alternatively, the heirs may choose to give away all of the assets included in the will by transferring their rights.

However, one often unaddressed question is what happens and when There are no heirs Who inherits the property of the deceased at the time of his death.

The circumstances surrounding this particular case vary greatly. In the event of loss of heirs, there is no one to assume the responsibility To settle the debts owed by the concerned individual during his lifetime.

Therefore, these debts remain unchanged in the documents of the Revenue Agency and can be Subject to a medical prescription Then he was discharged.

Alternatively, there is another course of action to consider regarding debts that accrue in the presence or absence of potential heirs.

In the event of a forfeited debt by the death of the debtorthere are penalties of an administrative nature or even criminal complaints related to personal liability.

Moreover, it should be noted that fines related to this category must also be taken into account Traffic violationsTaxes, administrative or penal offenses.

“Infuriatingly humble social media buff. Twitter advocate. Writer. Internet nerd.”