Investors’ expectations are heading towards a recession scenario for the US economy, and market trends reflect this new situation.

Behind every movement in the financial markets there is, or should be, a reason connected to some expectation. In other words, what is happening today with the prices of stocks, bonds, etc. is nothing more than a transmission of what is believed to happen tomorrow to a company, to an economy, or to other financial variables.

As such, the question to be asked in the face of such a profound shift in the markets is not how long this list price will last or how low it can go, but what motivates investors to act in this way. There aren’t many mayors in the city, and it’s all too easy to point to the Fed and its monetary policy as key to understanding how investor expectations are moving. Yes, raising interest rates has something to do with it. And above all it has to do with one possible side effect: stagnation. In other words: pushing prices towards each other, people spend less, companies invest less, so GDP growth gets weak, until it reaches deflation.

Inflation on the sidelines. Because the impetus for the Fed and many other central banks to take up the interest rate issue again is precisely the cost of living that has grown (or left to rise) so much in recent months. In the United States, when it comes to fighting inflation, the mind immediately goes to the early 1980s, in a powerful maneuver volker And a severe depression that cost victory over high prices. Taking a few more steps back, and questioning the Fed’s ability to quickly solve the price problem, many are reminded of the colossal mix of high inflation and stagnant growth ( Inflation accompanied by economic stagnationWhich of the scenarios is more pessimistic than the pessimists (except for the black swans).

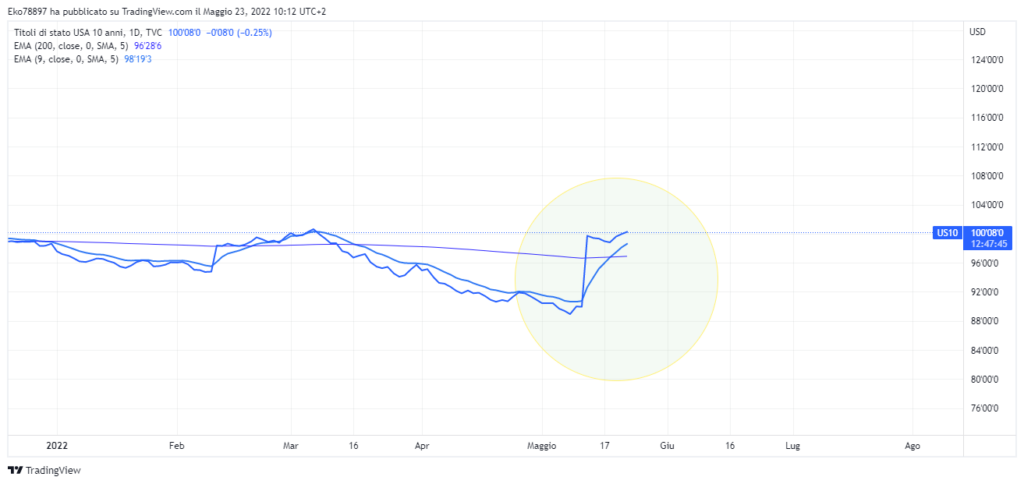

In this context, it is not difficult to imagine how investors’ expectations have changed. And in order to understand this, you just need to look at two parameters: the direction of the stock markets and – and most interestingly – the direction of the bond market, in particular US Treasuries. Over the past week, in the face of a massive sell-off in equities, we have seen a “rise” in US government prices. Now, if the business cycle theory is still correct, this behavior means only one thing: investors expect the interest rate to be unclear. In other words, a recession is more likely to occur with a subsequent cessation of the Fed’s restrictive policy. How is it possible? According to many, the probability of a recession in the US in 12/24 months has risen to about 30%, according to others, we will be in much lower percentages. And some analysts these days remember how the US central bank has historically withdrawn its forces when the odds of a recession within two years are between 30% and 40%.

In conclusion, it can be said that what is driving the financial markets at the moment are investors’ expectations of a phase of recession inevitable in light of the current restrictive policy adopted by the Federal Reserve. We will understand if the pessimism is excessive in the coming months, when we return to look at the quarterly data and consumption in the US.

Illustration by chinator

“Prone to fits of apathy. Introvert. Award-winning internet evangelist. Extreme beer expert.”