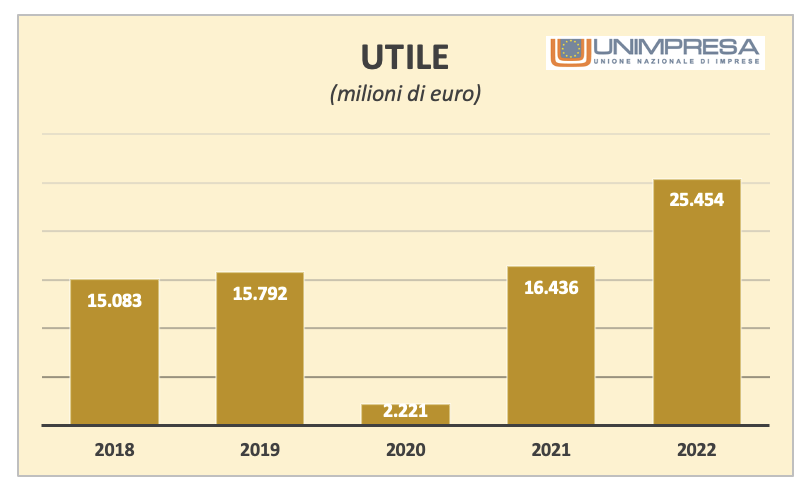

In 2022, thanks to monetary policy for B.C.E.Revenue attributable to lending was $45.2 billion, nearly $3 billion higher than commission-related revenue of $42.5 billion. And the “special” year 2022 suggested profit growth: 25.4 billion compared to 15.1 billion in 2018, 15.7 billion in 2019, 2.2 billion in 2020, and 16.4 billion in 2021.

This is highlighted among others by a report by Unipresa Study Center according to which, during the five-year period in question, the presence of banks in the region decreased significantly with the number of branches declining from 25,409 in 2018 to 20,985 in 2022 (-17%): Close 4,424 branches in five years.

Here are all the details.

Revenues of INTESA SANPAOLO, UNICREDIT, MPS, BANCO BPM, BPER and not only

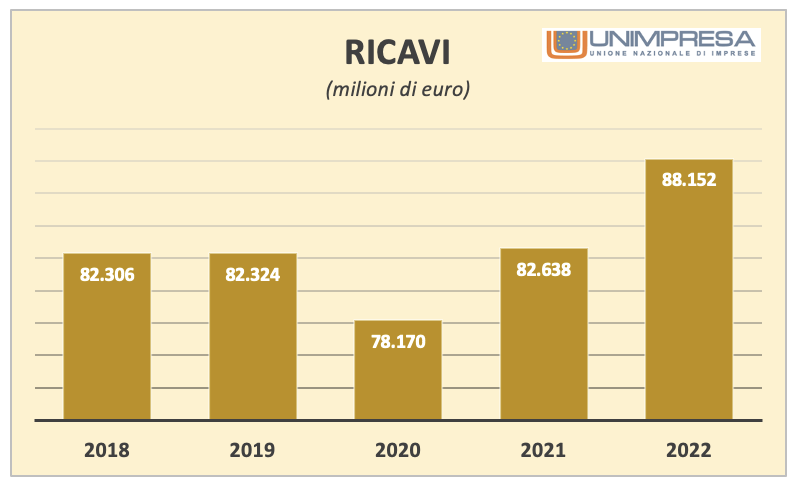

The revenues of Italian banks in the past five years, from 2018 to 2022, amounted to more than 413 billion euros, which is the time period in which the banking sector in our country made profits of nearly 75 billion (+69%), i.e. a third as about 25 billion, referring to The last year in which the European Central Bank began to gradually increase the cost of money, which in December reached 2.5% (and then to 4.25% last July): about 88 billion in revenue in 2022 and more than 45 billion is related to earnings on interest charged on loans provided for businesses and households, while about 42 billion refers to commissions on financial services and products; A result that pushed the return on equity to 9% from 5.6% in 2018 and from 5.7% in 2021.

WHAT HAPPENED TO THE COSTS OF INTESA SANPAOLO, UNICREDIT, MPS, BANCO BPM, BPER AND NOT ONLY

In the five-year period, costs remained stable at $55.5 billion, while provisions and adjustments fell to just over $10 billion. The effects of the Covid pandemic, which also marked the year 2020, with the lowest number of sales (78 billion) and profits (2.2 billion), did not affect the overall results achieved during the five-year period.

Unimbresa comment

“The data justifies the government’s intervention with the tax on the additional profits of banks. The executive action specifically targets the interest margin, that spread created by the commercial policies of the country’s credit institutions which benefit, and benefit greatly, from the increase in the cost of money that the ECB has decided to recognize very little, instead in terms of rewards, for their clients. Without moving a finger and without costs, banks collect tens of billions of euros. They are exploiting the evil policy of the European Central Bank, which, as we have been condemning for some time, not only does not produce the desired effects in terms of containing inflation, but is causing great harm to the real economy, with a very negative impact on credit. Both in terms of higher interests and in terms of increasingly stringent access requirements. For us, it is a bitter pill for the bankers to swallow, but on an economic level it is easy to digest: there will be no setbacks for the sector,” comments Vice-President of Unipresa, Giuseppe Spadafora.

Revenues of INTESA SANPAOLO, UNICREDIT, MPS, BANCO BPM, BPER and not only

According to the Unipresa Study Center report, which provided detailed data from the Bank of Italy, overall, Italian banks generated €413.5 billion in revenue in the past five years: €82.3 billion in 2018, $82.3 billion in 2019 and $78.1 billion in 2020. $82.6 billion in 2021 and $88.1 billion in 2022. Loan-related revenue (interest margin) accounted for the largest part in 2018 from service fees and the sale of financial products (41.8 billion versus $40.4 billion), but then became less Significance in the following three years: In 2019, credit achieved a turnover of 40.1 billion against 42.2 billion commissions, indicators that declined in 2020, albeit in the same proportions, to 38.7 billion and 39.4 billion.

What happened to the commission?

In 2021, it is clear that commissions of 44.2 billion “separated” 38.4 billion from the interest margin. “Counter overshoot” in 2022 thanks to the monetary policy of B.C.E. This raised the revenues attributable to lending to 45.2 billion dirhams, which is about 3 billion higher than the 42.5 billion related to commissions. The “special” year 2022 suggested profit growth: 25.4 billion compared to 15.1 billion in 2018, 15.7 billion in 2019, 2.2 billion in 2020, and 16.4 billion in 2021. Compared to 2021, last year’s profits increased by 9 billion ( +54.9%, while the turnover increased by 5.5 billion (+6.7%): the interest margin component increased by 7.1 billion (+18.5%), while commissions decreased by 1.5 billion (-3.6%). But over the five years as a whole, commissions, of 208.9 billion, represent the largest part of the revenue compared to the interest margin of 204.5 billion.

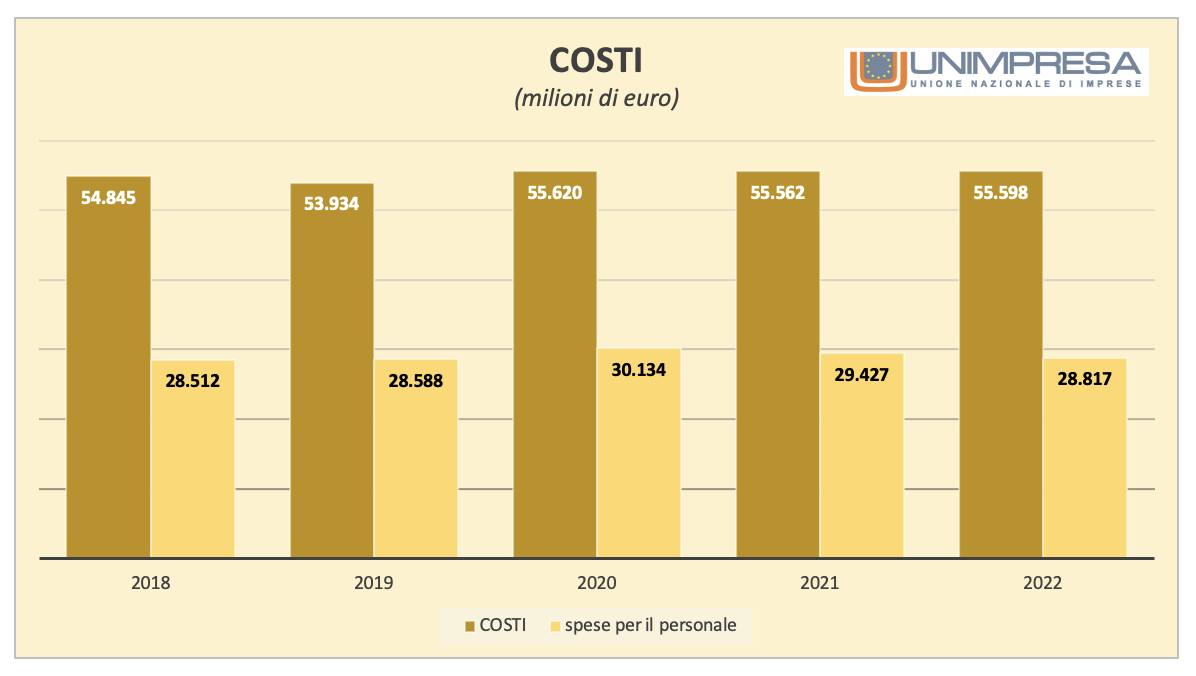

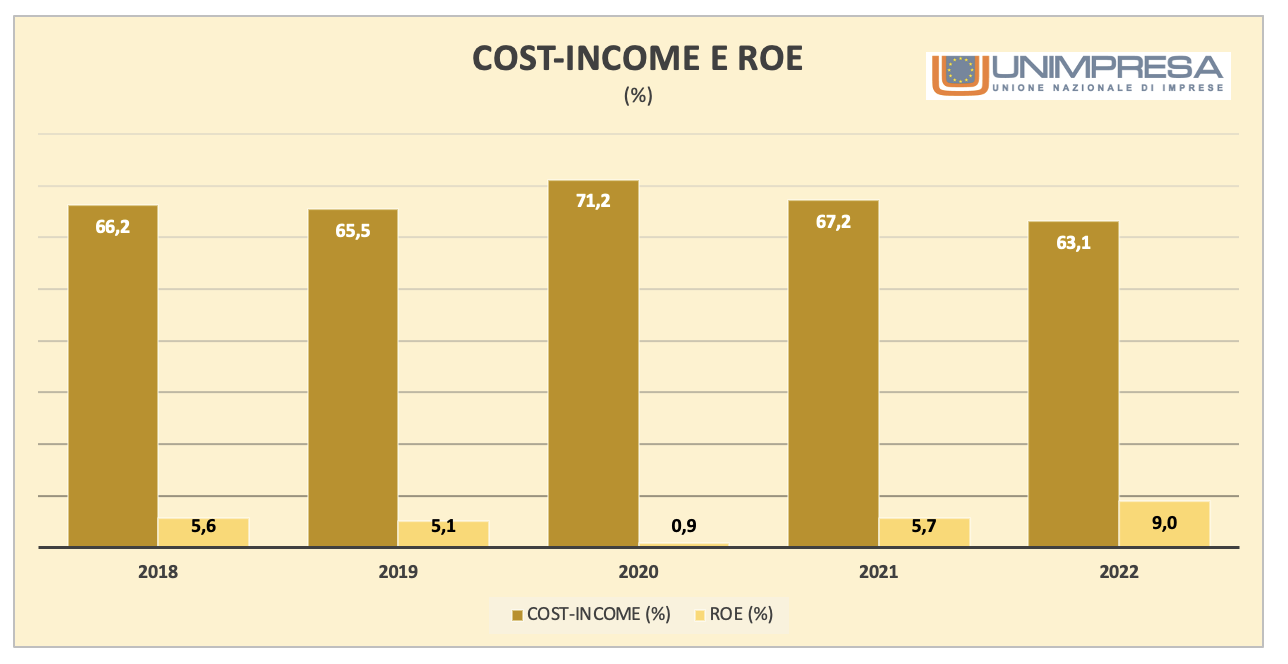

Costs stable at $55 billion, cost revenue down to 63.1% for Italian banks

And if revenues and profits increased significantly, the costs of the banking sector did not witness particular changes: 54.8 billion in 2018, 53.9 billion in 2019, 55.6 billion in 2020, 55.5 billion in 2021, and 55.5 billion in 2022. This context, a similar trend for personnel expenditures, decreased by 610 million last year (-2.1%), from 29.4 billion in 2021 to 28.8 billion in 2022 (it was 28.5 billion in 2018, 28.5 billion in 2019 and 30.1 billion in 2020). . Smart management brought the cost-to-income ratio to 63.1% in 2022: after it was 66.2% in 2018, 65.5% in 2019, 71.2% in 2020, and 67.2% in 2021; The cost-to-income ratio improved by 4.7 percentage points in five years and by a good 6.1 percentage points in 2022 alone, an improvement that can also be seen by comparing data on revenue, earnings and costs from 2018 to 2022: for turnover an improvement of 5.8 billion (+ 7.1% and profits of 10.3 billion (+68.8%), while costs remained stable, with a slight increase of 753 million (+1.4%).

Reducing provisions and adjustments by 39% compared to 2018, and the return on equity from 5.6% to 9%

Data on provisions and adjustments allow us to depict the deep stabilization of the banking sector. The health of institutions has clearly improved, and the risks, especially on the credit side, are getting lower and lower: Provisions and settlements amounted to 16.7 billion in 2018, 14.4 billion in 2019, 22.5 billion in 2020, to 12.4 billion in 2021 to 10.2 billion in 2022; Of which, 13.1 billion in 2018, 13.1 billion in 2019, 17.4 billion in 2020, 10.9 billion in 2021 and 9.1 billion in 2022 are attributable to impaired loans. 0.9% in 2020, 5.7% in 2021, and 9% in 2022.

Covid leaks sales volume (78 billion) and profits (2 billion)

However, the effects of the Covid pandemic, which also marked the year 2020, with the lowest number of sales (78 billion) and profits (2.2 billion), did not affect the overall results achieved during the five-year period. In the year of the pandemic, the Italian banking sector recorded the worst performance in the period under review: revenues amounted to 78.1 billion (38.7 billion from interest margins and 39.4 billion from commissions). Costs amounted to 55.6 billion, but the component related to personnel expenditures, equivalent to 30.1 billion, was the highest in the five-year period. Provisions and adjustments, at 22.5 billion, also represent a negative record, especially for 17.4 billion due to non-performing loans. It is therefore not surprising that the cost-to-income ratio reached 71.2% and the roe at 0.9%.

Closing 4,424 branches in 5 years, downsizing 665 agencies in 2022: abolition of legal branches

From 2018 to 2022, 4,424 branches were closed: the regional presence of Italian banks decreased significantly over the five-year period in question, with branches down by 17.4%, from 25,409 to 20,985; Last year alone, there were 665 closures (-31%), an average of 55 closures per month, more than 2 per working day. The number of bank branches reached 24,312 in 2019, 23,480 in 2020, and 21,650 in 2021. The rationalization of the regional network, which coincided with the gradual and continuous decline in banking companies: the number of banks and groups reached 505 in 2018, and 488 in 2019 474 in 2020, 456 in 2021, and 438 in 2022; Thus, in the five-year period, there was a decrease of 67 companies (-13.3%) among mergers, acquisitions and rescues, which equates to a decrease of 13.3%. Compared to the total, in 2018 there were 22 cooperative banks and 268 cooperative credit banks, which decreased in the following four years, respectively, to: 21, 259, 21, 248, 20, 238, 18, and 226. “The gradual reduction of branches is a very big social problem: banks are guarantees of legality, which are repealed instead in the silence of the government, and their removal from regions brings families and firms closer to illegal economic systems, often resulting in the extradition of citizens and men of business to the world. Weapons of criminal organizations» says Vice President of Unipresa, Giuseppe Spadafora.

“Infuriatingly humble social media buff. Twitter advocate. Writer. Internet nerd.”