In the story of the trends that invest the world of technology, events, heroes, clashes and alliances that can support the scenario of a story or a TV series are often encountered. It just so happened to us with the profile on ChatGPT (which you can find at this link) that we presented the AI gold rush: There are countries, governments and all the big tech companies in the race. With this new version of our format, we will be exploring another trend, which has risen to the top of public discussion after the pandemic. We are talking about chips, semiconductors that live under the hood of all technological devices. If the addiction to these things has already reached this level of complexity in the daily lives of individuals, try to raise it to the level of competition between nations. It can set new global balances that are not yet determined. And the West does not have a victory in its pocket.

Intel plant in the United States

What chips are we talking about

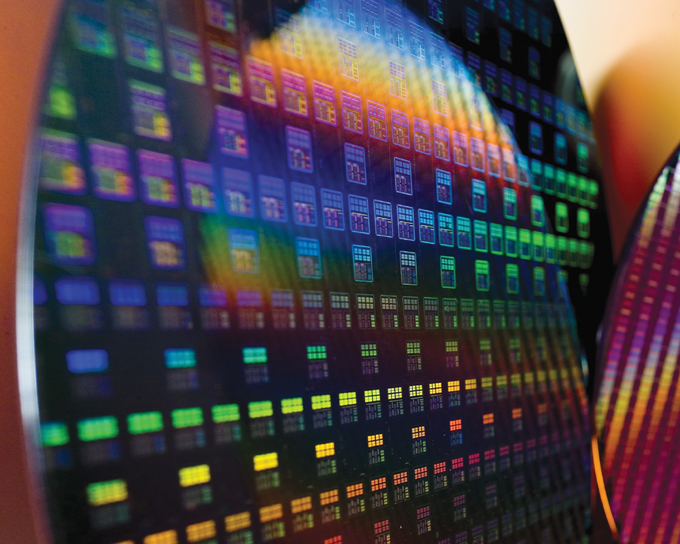

The electronics and ICT industry owes its economic weight to research, development and manufacturing to semiconductors. These are electronic circuits that companies have miniaturized over the decades, greatly increasing their speed and efficiency. One of the most famous chips is the CPU, which is a central computing unit that can be defined as a type of general microprocessor. These are the gems that make the technology we have in our pockets, on our wrists, in the garage, and at home. And we all realized how addictive we are after the numerous lockdowns, factory closures and crises that have damaged the supply chain in recent years.

China and the USA

It’s not just consumers playing in the chip game. Technology certainly plays an essential role in our lives and it is not likely that we will be able to go back. However, if we widen our eyes, the game we are playing is another game. Chip means skills and hardware, but also industry (including war). Thus, the movements of recent years between the two sides of the Pacific are logical: the United States under Biden, in parallel with the presidency of Trump, has made relations with Beijing more tense. The Chip and Science Act passed in the US is worth $52 billion in incentives. The plans are to build chip factories on US soil, just as is done in the auto sector with the help of the inflationary measure.

China, which currently does not threaten the United States in terms of device production, is moving towards self-sufficiency. It is almost impossible to achieve the goal in such a diverse and complex industry. But the Made in China 2025 plan, which dates back to the past decade, aims to make the country’s manufacturing a global standout in various fields, including the chip field. Beijing has put $1.4 trillion into a multi-year plan that has yet to bear fruit. There are more than 90 chip farms in China that are in the pipeline or have recently become fully operational. How much will they weigh on the scale?

Meanwhile, the rains of investments have already watered the seeds of a new technological geography, which in a few years will see the blossoming of new factories. In the United States, the Korean giant Samsung announced an investment of $ 17 billion, and the beneficiaries will be Taylor, a city in Texas. Meanwhile, Biden marked another important announcement in 2022: TSMC, Taiwan’s largest chipmaker, will invest $40 billion in Arizona to build its second chip factory (there are currently no deals of this scale in the US state). And what about the American company Intel? It is also considering plans abroad, raising expectations in Germany for more government subsidies in exchange for a plant in Magdeburg and even Italy holding its breath in anticipation.

Taiwan

They called it Chip Island. A country that since the middle of the last century was seen as a rebellious province by mainland China, and a strategic ally of the United States. Meanwhile, it has built its technology knowledge by investing in the industry. The aforementioned TSMC, short for Taiwan Semiconductor Manufacturing Company, is the world’s leading semiconductor manufacturer, as well as the most capitalized Asian company on the planet: its market capitalization is $520 billion, a figure that puts it 13th in the world. . If we look at the chip industry, the giant controls 60% of the manufacturing and assembly phase (Samsung, which is a major competitor, owns 13%). TSMC alone guarantees 20% of Taiwan’s GDP.

These simple numbers are enough to understand what is at stake not only when it comes to a supply chain crisis and a shortage of chips. The issue of semiconductors gained vital importance to the global economy after the outbreak of the war in Ukraine and the reflections of observers on the upcoming Chinese moves. In light of the Russian invasion, how close or likely is a Chinese military campaign to re-annex the island of Taiwan? The answer to this question could change the global scenario in a very short time, with heavy and perhaps more dangerous effects than those of the energy crisis on the European continent in 2022. The annexation scenario by the power of war could raise questions about the existence of industry, factories and machinery of TSMC, a giant whose size Its sales in 2021 are more than $56 billion.

Europe

In this scenario, Europe is undoubtedly caught between investment policies and decisions that often do not depend on individual states or on the critical mass of the union itself. In February 2022, the committee led by Ursula von der Leyen approved the Chip Act, an investment package of €42 billion to stimulate domestic semiconductor production. The front man of the Brussels executives defined it as a plan to make the old continent the leader in the chip market: by 2030, 20% of production should take place in Europe.

the #EUChipsAct It is a plan to make Europe a leader in the chip market.

We have a very clear goal: by 2030, 20% of the world’s microchips should be produced in Europe. https://t.co/hmYxyv5odd

– Ursula von der Leyen (vonderleyen) February 8, 2022

For now, the big tech companies are still evaluating their moves, with Intel yet to start building its announced factories also between Germany and Italy. In total, the American giant should invest $ 88 billion in Europe. But, if it wasn’t clear yet, we’re dealing with a marathon, not a 100m sprint. Italy has various concessions on its part, as it sometimes does (see space economy). Federico Faggin, originally from Veneto, contributed to the creation of the world’s first microprocessor at Intel in 1971. Our country plays an important role with STMicroelectronics, a company that has nurtured many talents internally and which has subsequently founded start-ups all over the world always in the semiconductor sector . The headquarters is located in Geneva, but the two majority shareholders with equal shares are the Italian State and the French State.

StartupItalia profile: links to find out more

From our magazine:

- The Chip War and the Role of Taiwan. an idea

- Chip law in Europe and why it affects startups too

- He worked for the Italian-French multinational STMicroelectronics. Today he is at Navitas, a publicly traded semiconductor company

- The role of microchips in biotechnology

- The US also has its own chip law, which is worth $52 billion in subsidies

- China does not want to lose the war over chips

- Intel wants to invest in Italy, but is also looking elsewhere. In Germany, the stakes are up

- TSMC moves to attract talent

- Samsung and plans in the USA

- Meet us in the semiconductor market

- Profile of Federico Faggin, the Italian who worked on the first microchip

From the international press:

- from financial times Insight into US chip law

- site of Massachusetts Institute of Technology Extension Boston, The topic of chips and their role in American leadership of advanced computing

- Taiwan’s role in the chip war. An article about Atlantic Ocean

- the The New York Times Books about cold war technology

- from Watchman Commentary on the role of semiconductors in geopolitics

- the edge He broadcast one of his podcasts where he interviews Chris Miller, author of Chip War

“Prone to fits of apathy. Introvert. Award-winning internet evangelist. Extreme beer expert.”