Car tax, what to do to stop paying it: great news. The year 2023 begins with an important confirmation for all motorists

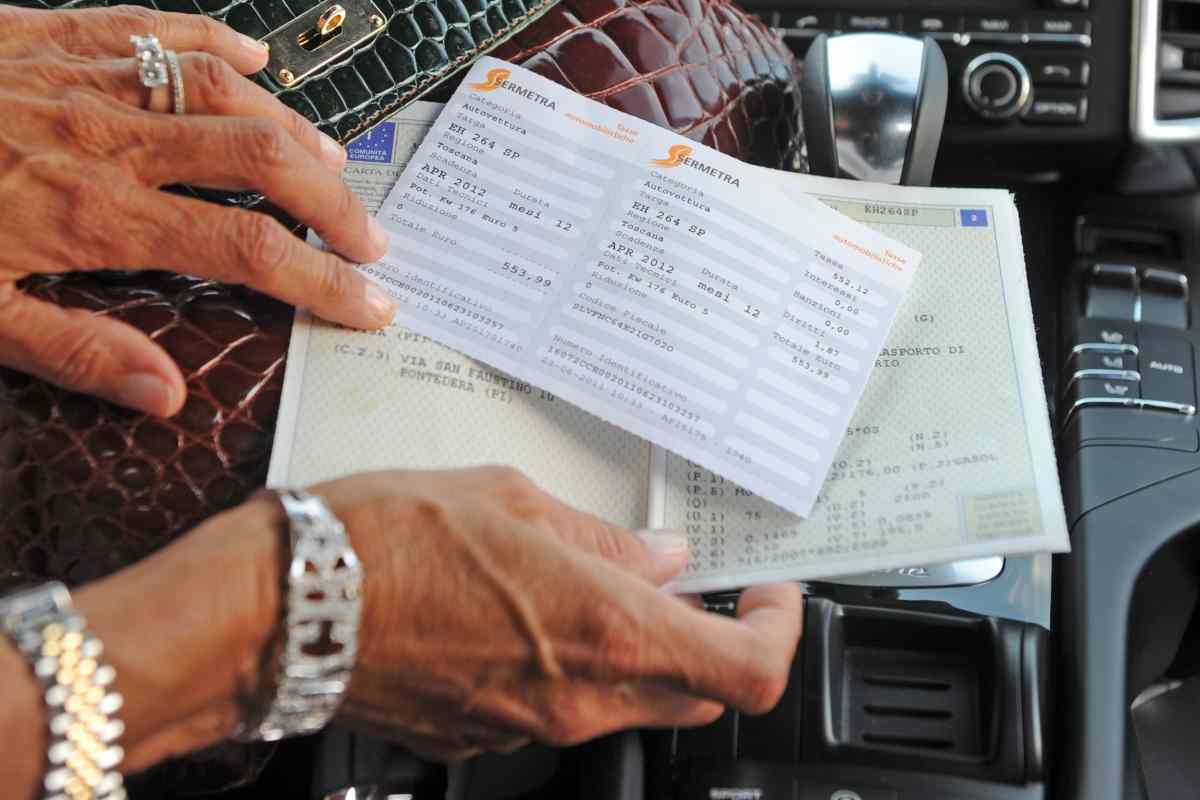

the car taxes Affect all cars and car tax No difference. It must be paid at least once a year to the region, or to the revenue agency as it happens in Veneto and Calabria. But there is also the possibility, quite legal, of do not pay more.

Almost all Italian regions in fact, to encourage sustainable mobility and therefore purchase Electric or hybrid cars It provides for exemptions from the payment of stamp duty. You do not need to submit a specific application, you just need to be able to prove that you own the car

There are important differences from region to region, but after the recent vote by the European Parliament that will remove all petrol and diesel vehicles from the roads from 2035, the exemptions are not going away. In the meantime, let’s see together how they work today.

Car tax, what to do to stop paying it: the regions decide

in Piedmont There is a 5-year exemption from the first registration if the hybrid vehicle does not exceed 100 kW. On the other hand, electric cars benefit from permanent exemption. in Lombardy Hybrid cars registered after January 1, 2019 pay 50% of the road tax for the first five years while electric cars are exempt for life.

in Campania Hybrid cars do not pay road tax for three years from the date of first registration. There is also a 5-year tax exemption for electric cars, motorcycles and electric scooters from the date of first registration.

L’Emilia-Romagna It determined that hybrid cars first registered in 2021 do not pay property tax for three years (2021, 2022 and 2023). However, this is only if the amount does not exceed 191 euros per annum, while there are 5 years of exemption for electricity.

In Abruzzo, three years exemption from paying property tax for hybrid cars and five years exemption for electric cars, motorcycles and electric scooters, starting from the first registration. Instead of that Calabria There are no exemptions for hybrid cars, but there is an exemption for a period of 5 years from paying car tax starting from the date of first registration for electric cars

In the Lazio No motor vehicle tax, for hybrid cars in the first three years after registration. Electric cars, motorcycles and scooters do not pay road tax for 5 years from the date of first registration. In Basilicata, hybrid cars with first registration as of 2015 have a 5-year tax exemption for electric cars, mopeds and electric motorcycles. In Liguria, there is a 5-year exemption for hybrid cars, just like for electric cars.

Car tax exemptions, and how they work in Italy Region by region: There are some differences

in Trademarks Hybrid cars are exempt for 6 years after first registration and 5 years for electric cars and in Mollys hybrids they are exempt from property tax for 2 years from first registration, but hybrid cars for 5 years. In Friuli Venezia, Giulia does not pay car tax for the first three years from the date of registration of hybrid and electric cars, and for five years from the date of first registration.

in Veneto Exemption for 3 years for hybrid cars and 5 years from the date of first registration for electric cars. Even better in Puglia: 6 years for hybrid cars and 5 years for electric cars. in the islands? In Sardinia, only 5 years for electricity, and in Sicily, 3 years for camels and 5 years for electricity.

Finally, in the autonomous province of Trento as the province of Bolzano for a period of 5 years for hybrid and electric, in Tuscany In Umbria there is no exemption for hybrid cars and five years for hybrid cars. Hybrid cars in Valle D’Aosta do not pay road tax for the next four years, which rises to 5 for electric cars.

“Infuriatingly humble social media buff. Twitter advocate. Writer. Internet nerd.”