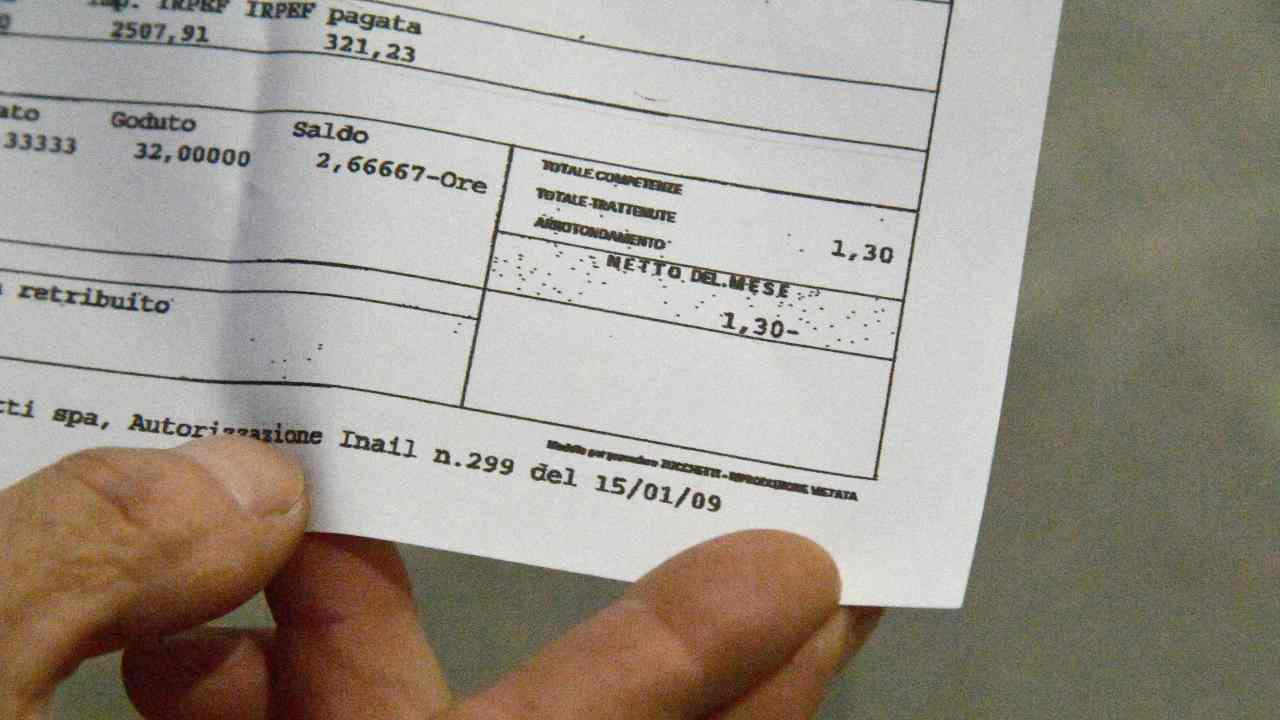

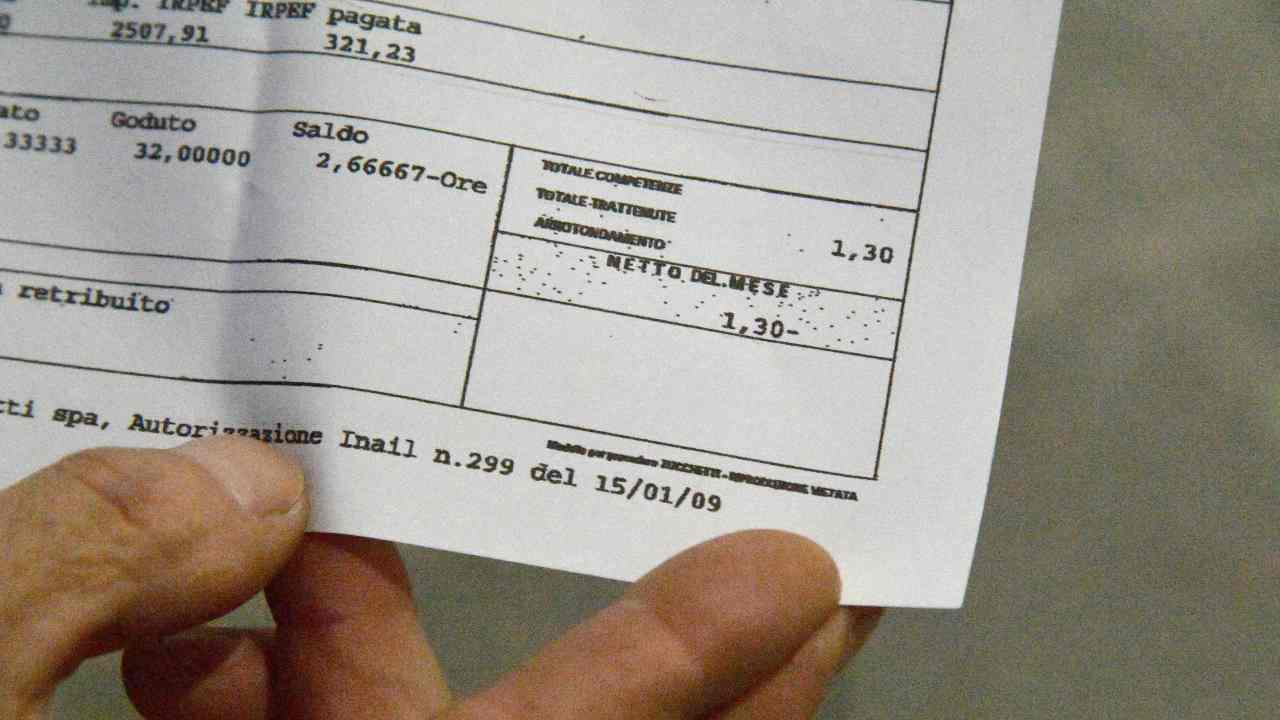

Income tax increase in salary. In fact, additional fee increases are expected due to the new law of 2022. But it all depends on where you live

difficult Economic situationbecause of the difficult situation of the purchase problem and Dear EnergyIt shows no signs of improvement, quite the contrary. Expected new increases for Additional personal income tax because of the new Authorization Act 2022.

However, it all depends on the place taxpayer residence Moreover, the greatest effect will be recorded by those who have Highest average income. But it will not be an increase that affects everyone randomly, in fact there will be fundamental differences. Here any of them.

Income tax is going up, it depends on where you live

In addition to the reduction from five to four of personal income tax ratesthere will be more Ads Which will invest the Italian taxpayers. Indeed, it will be important to monitor the place of residence, as this will be decisive for the increases we are talking about.

For the residents of the area Lazioin fact, the base rate, which now amounts to1.23%will be subject to an increase in 0.5%. Increment carried out with a goal consume Compensating the health deficit in our country.

Furthermore, the personal income tax rates, except for the first rate, will all be subject to their rates Maximum This is b%. Especially those who have a medium to high income, specifically those who receive a monthly salary from 35 thousand to 40 thousand euros per year.

as far as 35 thousand The euro, in fact, the additional will remain constant e without change. For those who, on the other hand, have an income in between 35 thousand Which 40 thousand The euro, there will be a slight decline to some extent, in the range between 194 And the 174 euros. To enter higher (described above 75 thousand EUR), increases will be between 126 And the 206 euros.

For the residents of the area Campania Instead, the income tax deduction will be implemented until 28 thousand euro. This, in fact, will exist €90. For those who belong to middle rowsOn the other hand, the cuts will be very small, especially for those with an income of up to 60 thousand euro. However, very large increases in incomes ranging from 50 to 100 thousand euro. More modest, however, for the same income (and therefore higher than 50 thousand EUR) but with accommodation in Piedmont and in Molise.

“Infuriatingly humble social media buff. Twitter advocate. Writer. Internet nerd.”