Until next January 25, taxpayers can benefit from a personal payment plan that allows the payment of the tax amount in 10 monthly installments (from February to November) and without late interest.

The monthly rate is calculated individually for each taxpayer, according to his or her tax liabilities. The monthly payment calculation takes into account changes in the taxpayer’s situation (such as adding or removing tax obligations for the purchase or sale of new goods, etc.), and the installments are adjusted automatically. Therefore, adjustments will be made automatically throughout the year.

This payment method applies to taxes due periodically:

- car tax,

- Tax on real estate (urban or rural in nature)

- Garbage collection fees

- Fords

- A fee for usufruct or benefit from the surface of the public road, its floor, and its interior

- Tax on economic activities

- Collecting public price waste.

Late interest will not be charged to people who benefit from the customized payment plan or require a guarantee, as long as the installments are paid within the specified terms. The monthly payment frequency consists of 10 instalments, which will be collected on the 5th of every month, from February 5 to November 5.

The beneficiary of this system is required to not have a debt owed to the city council, unless the debt is in installments or is pending. The fee generated by the personal payment plan must be greater than €15 and the mandatory direct debit to pay the fee in one account.

Access personal payment plan procedures

People who are already subscribed to this payment method do not have to take any action and are automatically enrolled in the new personalized payment plan.

To internalize the plan can be done through the following life:

- Virtual tax office: ovt.reus.cat

- In person, at the service of the information and attention of taxpayers (c/Sant Llorenç, 25), always by appointment (citaprevia.reus.cat)

Bank address

Taxpayers who are not on a personal payment plan also have a direct debit option to make paying more convenient. In this case, the Reus City Council will pass the receipt through the financial institution during the voluntary period listed on the taxpayer's calendar.

Direct debit details can be found at: https://seu.reus.cat/seu/carpetaCiutadana/tramit/43360

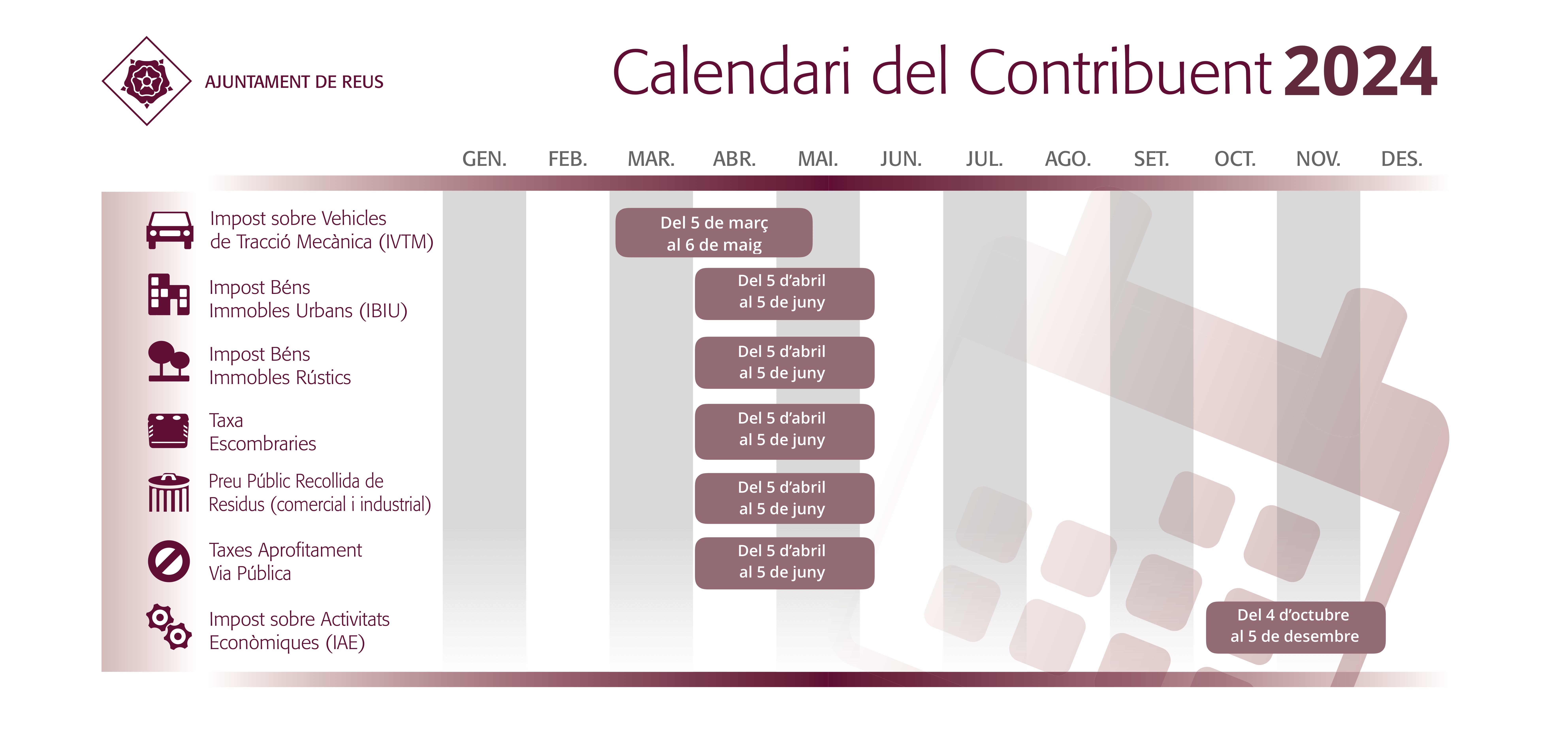

Taxpayer Calendar

Individuals or legal entities that do not fall under a personal tax payment plan must pay taxes according to the 2023 Taxpayer Calendar detailed below:

- From March 5 to May 6. Tax on mechanical traction vehicles (IVTM)

- From April 5th to June 5th. Urban property tax (IBIU)

- From April 5th to June 5th. Rural property tax

- From April 5th to June 5th. Garbage fees/garbage collection general rates

- From April 5th to June 5th. Public road use fees

- From October 4th to December 5th. Economic Activities Tax (IAE)

“Infuriatingly humble social media buff. Twitter advocate. Writer. Internet nerd.”