Real estate never stops. Since January, the sector has grown by €9.2 billion compared to last year, with collections of €45.2 billion. Italy and the European Union are at the forefront of the real estate crowdfunding race, but competition from the USA continues. China, on the contrary, is witnessing a strong crisis in the real estate sector, first with Evergrande and then with Country Garden.

Looking at our country, the real estate market has closed a twenty-year cycle, according to analysts. In the first decade of the 2000s, price increases exceeded 30%, then fell sharply after the mortgage bubble burst. After the COVID-19 pandemic, access to credit and the level of interest rates have become the main drivers of growth in this sector.

Real estate, data

In 2023, stocks will decline by 12%, while access to credit will decline by 40%. Meanwhile, applications for mortgages have risen since the beginning of the year and average interest rates have risen to more than 5%. In the period from December 2022 to June 2023, inflation reached 71 billion euros. However, a completely different market awaits us in the future compared to the past, according to experts. In fact, it will feature much higher reactivity and volatility than in the past. This means that it will be increasingly conditional on external factors such as monetary policy and European rules. The rules will impose costs that should not be underestimated on national real estate, which lags far behind from an energy efficiency standpoint. The EU goals include achieving Class E by 2030 and eliminating polluting emissions by 2050. The least can be said about the ambitious goals, if we take into account that Italian real estate consists, according to Istat, of:

Class A: 678,000 units 5%

B: 288,000 units 2%

A: 523,000 units 4%

D: 1,269,000 units 10%

E: 2,119,000, 17%

F: 3,158,000, 25%

Ground: 4,465,000, 36%

The biggest challenge relates to the renovation and rehabilitation of buildings in terms of energy, which, according to analysts, is one of the main levers capable of raising demand and prices. In this game, real estate crowdfunding will play a central role, precisely because of the ability to raise money from different investors for one or more real estate projects. Other key elements to monitor in the residential market are demographic change, redistribution of population across the territory and migration flows.

USA and Texas

The US real estate market is starting to resume activity, but prices are still low. In August, advertising increased by 1.8% compared to the previous month. This result was achieved thanks to a 7.4% increase in sales, according to RE/MAX’s US Housing Market Report. However, the average prices are the same as in July: $425,000. However, compared to August 2022, new listings were down 13.2%. Meanwhile, home sales fell 13.1%, compared to a 3.7% rise in the median price. However, the number of properties on the market is on the rise, recording a 2.7% increase in August this year compared to the previous month. However, a comparison with August 2022 shows a 13.2% decline. Texas deserves more attention. In fact, in recent years, housing affordability has contributed to the arrival of a wave of new residents. However, since the end of summer, this trend has begun to reverse. In fact, prices are rising, while the average income of the population has not changed.

Real estate, Europe

The European real estate market is expected to end the year in negative territory, despite its recovery in recent months. The volume of sales of the five largest countries in the European Union will reach about 900 billion euros, a decrease of 1.2 percent compared to 2022, according to European Outlook 2024 estimates. But Italy records +3.6 percent compared to 2022, thanks to the residential and logistics sectors, which raise its sales volume to 144 billion euros. . On the other hand, the hotel and commercial sectors are performing poorly, as they are declining. Future growth is 2%, bringing its sales volume to 150 billion euros, according to estimates. On the other hand, the residential market is expected to decline slightly, but prices will rise slightly.

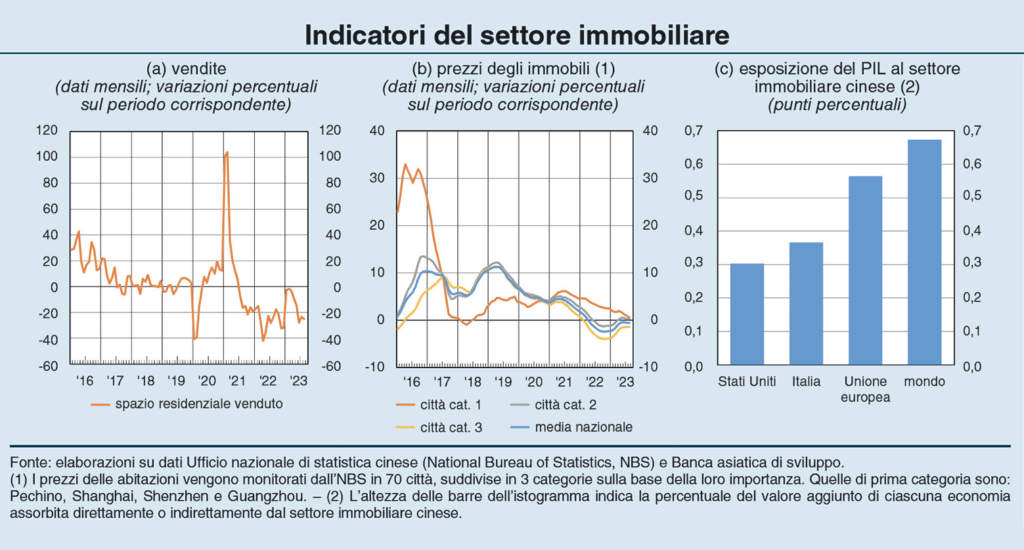

Real estate, China

Chinese real estate companies have often faced financial problems in recent years. The latest – after Evergrande – is Country Garden, the first company in the sector in terms of turnover, to delay the payment of interest on its foreign currency securities. The collapse of the groups led to a decline in the confidence of international consumers and investors, with repercussions on trade, prices and currencies. As a result, sales volume in the period from January to August decreased by 30% compared to the same period in 2019. Moreover, purchases of construction land decreased by -90%. Alarming numbers, as one-fifth of local authorities’ expenses are funded by the proceeds from the sale of these plots. ©

The article is taken from the November 1, 2023 issue of IL magazine bulletin. Participate!

“Prone to fits of apathy. Introvert. Award-winning internet evangelist. Extreme beer expert.”