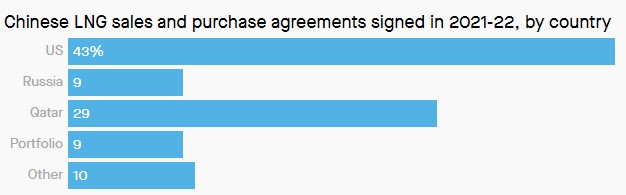

China signs many long-term LNG supply contracts, relying primarily on its rival superpower: the United States. Here are the advantages and risks for Washington and Beijing.

Cheniere Energy, a major US exporter of liquefied natural gas (LNG), reached a 20-year supply agreement this week with China’s ENN Natural Gas.

Contract with Qatari energy

China recently signed several long-term LNG purchase contracts. Just one week, which lasted twenty-seven years, between the oil company CNPC and the Qatari energy company QatarEnergy; Sinopec Petrochemical Group did the same in November 2022.

China chooses LNG supplies and long-term requirements

LNG is good for China to reduce coal consumption and reduce greenhouse gas emissions (it is the country that produces the most, about 30 percent of the global total). Long-term contracts allow the country to guarantee long-term supply certainty and protect itself from price volatility in the spot, daily and wholesale markets that are most affected by geopolitical crises and concerns about supply.

As a note quartzChina is targeting a small number of LNG supplier countries: Australia, Russia, Qatar and the United States. But the countries that will contribute the most to the growth of Chinese liquefied fuel imports will be Qatar and America, according to a recent report byOxford Institute for Energy Studies.

Energy trade between the United States and China

In 2021, despite economic and strategic competition, US LNG exports to China are at record levels. In 2022 there was a decline, but that was partly due to the Chinese economic slowdown due to the zero COVID policy. In Washington – writes quartz – Even the most staunch politicians with China are in favor of this energy trade to support the growth of the industry oil and gas.

– Also read: How is the trade decoupling between the US and China going?

Data from the Oxford Institute for Energy Studies says, in fact, that the Americans will export a lot of LNG to China in the next few years.

The United States accounted for 43 percent of the fuel purchase agreements signed by Chinese companies in 2021 and 2022. It is followed remotely by Qatar, with 29 percent. Russia’s share is only 9%.

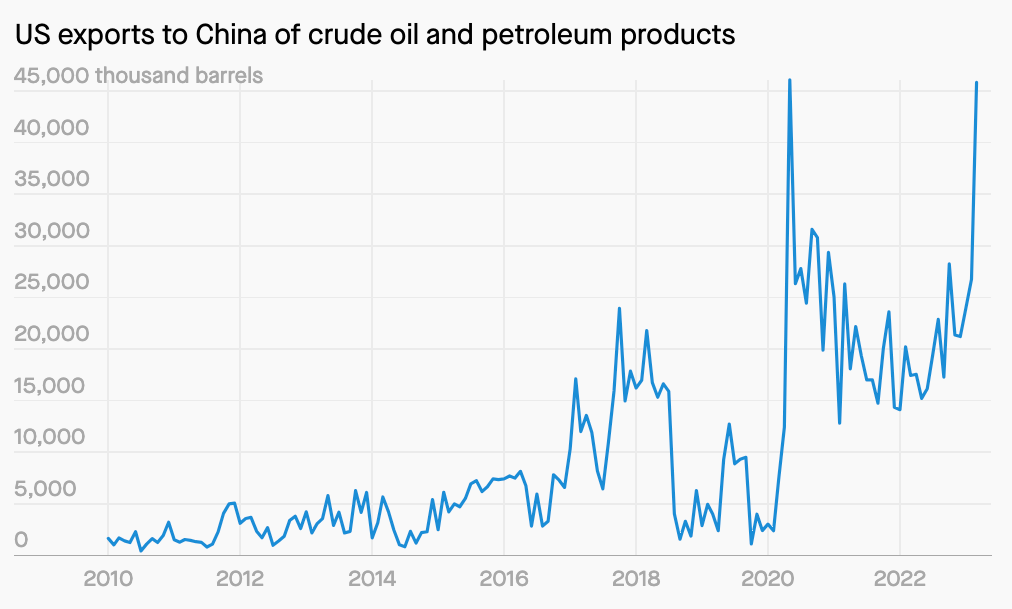

It’s not just LNG: The oil trade is also strong

Moreover, Chinese imports of US crude oil and oil derivatives are also increasing, preferring cheaper prices compared to the international benchmark Brent. In March 2023, Refinitiv analyzes were cited by say ReutersUS oil exports to China reached their highest level in two and a half years. In April it was 850,000 barrels per day, the highest level since May 2020.

Benefits and Risks: A Field Analysis (Oxford Institute)

Michel Meidan, author of the Oxford Institute for Energy Studies study on China energy policy, writes that “in the future, the United States and China will increasingly depend on each other when it comes to oil and gas. While this creates opportunities, it also creates vulnerabilities for both sides.” : The United States can limit the flow of oil and gas to China, which will affect the availability and cost of these resources, but this would harm the commercial interests of the Americans.

– Also read: Will Europe depend on the United States for energy?

“Prone to fits of apathy. Introvert. Award-winning internet evangelist. Extreme beer expert.”