Fed weakness in the aftermath of the banking crisis and declining inflation, generalized distrust of traditional sectors (financial above all) and resurgence in assets such as the tech sector have rekindled investor interest in some market-hit stocks for some. the time now.

After Meta Platforms Inc (NASDAQ:) closed on a positive note, here’s another Big Tech company currently in the portfolio, which bought in tranches during the dips, is Alphabet Inc Class C (NASDAQ:).

ALPHABET INC. It is a holding company. The company has stakes in Google Inc (NASDAQ 🙂 (Google). Divisions of the company include Google and Other Bets. The Google segment includes Internet products, such as Search, Ads, Commerce, Maps, YouTube, Apps, Cloud, Android, Chrome, and Google Play, and hardware products, including Chromecast, Chromebook, and Nexus, that are sold by the Company. Technical infrastructure and virtual reality are also included in the Google sector. The Google segment is advertising and sales of digital content, applications and cloud services, as well as the sale of Google-branded devices. The Other Bets segment is made up of various operating segments, and includes companies such as Access/Google Fiber, Calico, Nest, Verily, GV, Google Capital, X and other ventures. The Other Bets segment is the sale of Nest hardware products, internet and TV services through Google Fiber, and licensing and research and development services through Verily.

Data at a glance

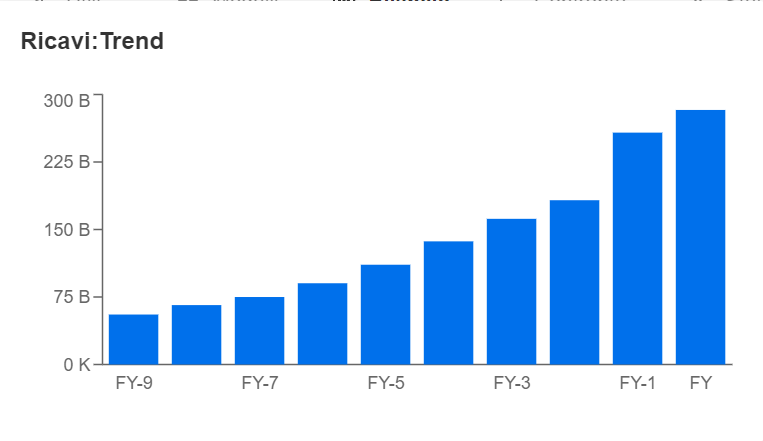

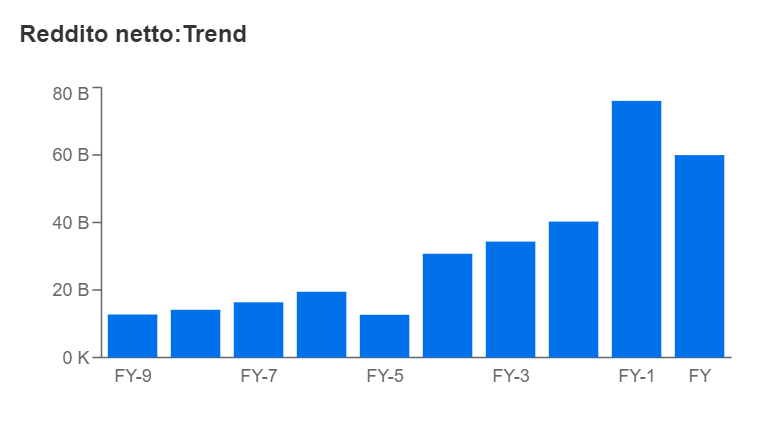

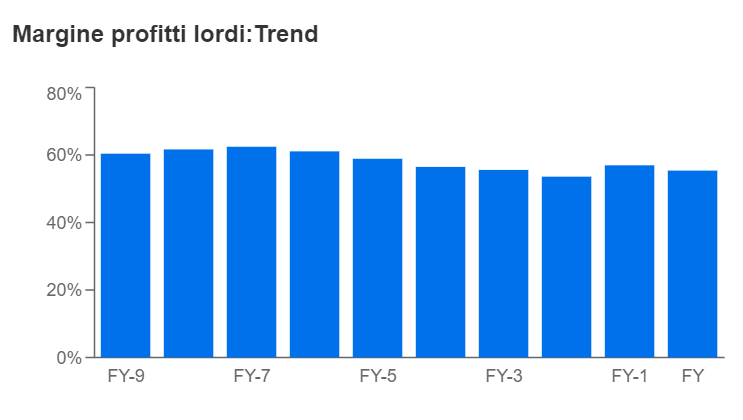

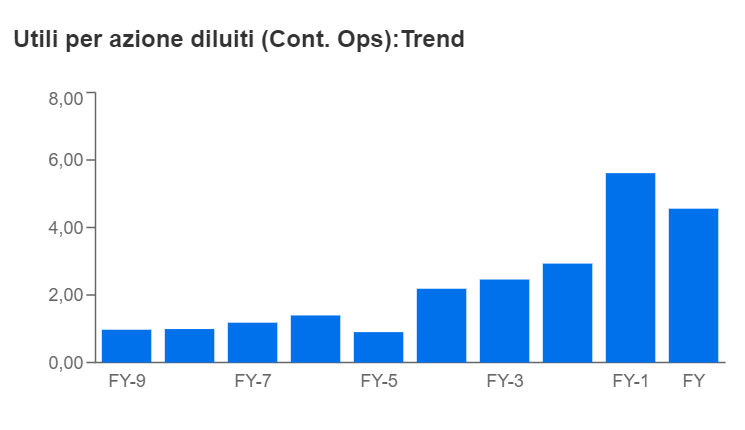

Let’s start immediately by looking at the history of the balance sheet, from which we get many useful indicators, including:

The trend of sales and earnings is increasing over time, as well as a stable margin (last year all major technology and advertising companies faced setbacks, but Alphabet Inc Class C (NASDAQ: ) has the position and competitive advantage to recover quickly, thanks to tools like Youtube and AI).

The EPSd (diluted earnings per share) growth rate has been 18.8% over the past 10 years.

Balance sheet and cash flow

Between liquidity and short-term investments, Alphabet holds more than $114 billion, with total current assets of about $165 billion. This in comparison to current liabilities (69 billion) ensures an excellent short-term balance.

The debt-to-equity ratio is really excellent (currently it’s 0.42, I consider optimal ratios equal to or less than 0.5/0.6).

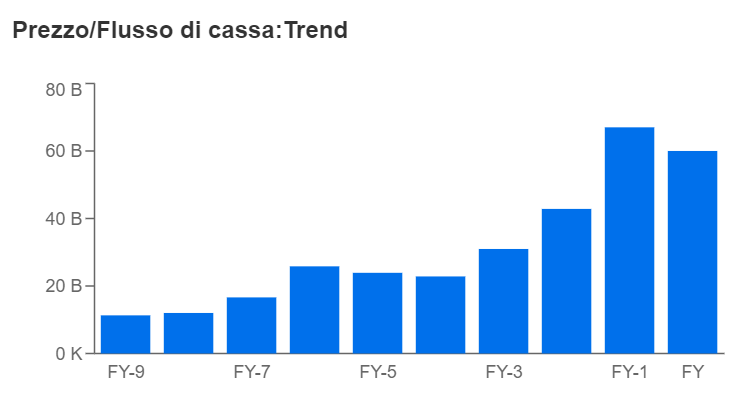

On the cash flow side, the operating side is following a healthy but choppy growth trend, even if it’s generally positive.

With BF 60 billion (latest available), the yield from FCF is around 4.5%, again good but not exceptional (the optimal yield for me is around 8-10%).

Ratings

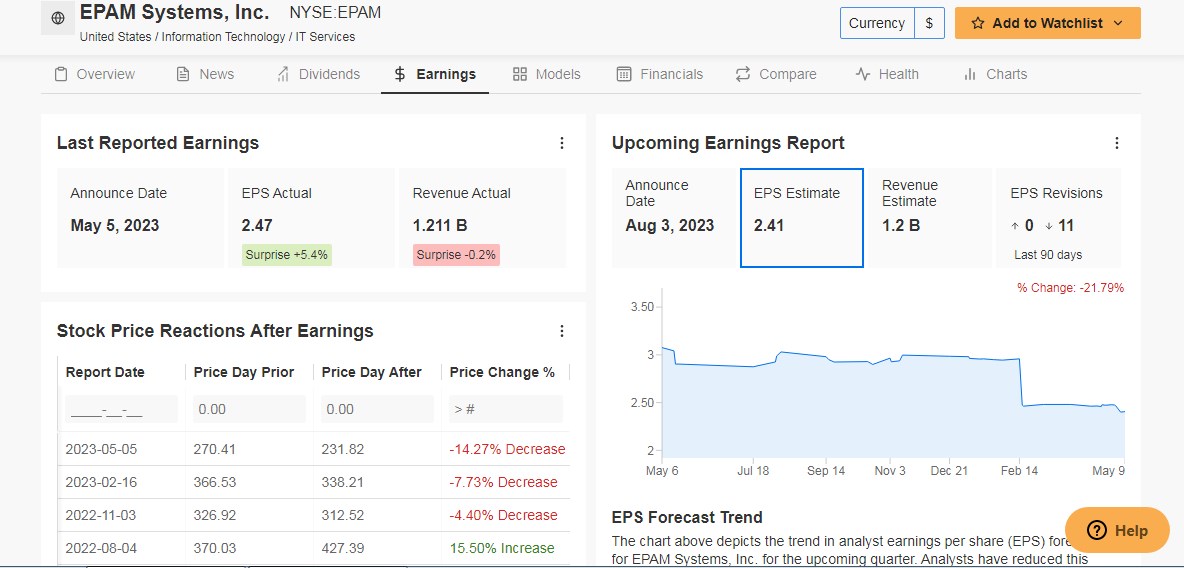

Now getting to the valuations, notably, the stock currently has a discount of just under 22% to fair value, giving about $128 a share (based on an average of 13 different models).

Even analysts today are shooting for a price target of $128 and a potential upside of around 22%.

Overall, however, the potential for more growth is there, especially if interest in the technology sector returns.

Source: InvestingPro

Source: InvestingPro

Analyzes were performed using InvestingProOr the link to the tool by clicking in the image or here.

I remind you that to properly evaluate an action starting from the financial statements, you can register for free in the next webinar on March 27, which you can find at this link.

Until next time!

“This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, advisory or investment recommendation and as such it is not intended to stimulate the purchase of assets in any way. I remind you that any type of asset is evaluated from several points of view It involves high risk, and therefore every investment decision and the risks associated with it remain the responsibility of the investor.

“Infuriatingly humble social media buff. Twitter advocate. Writer. Internet nerd.”