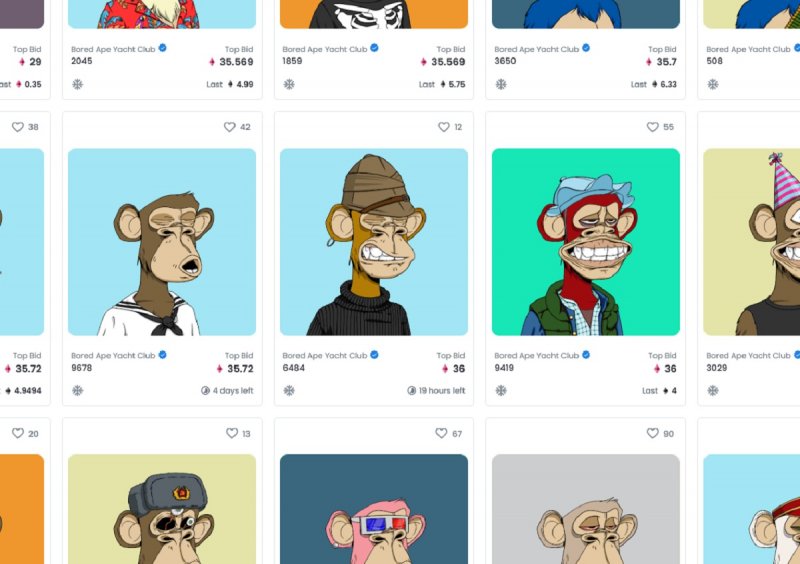

According to the website NonFungible and the Wall Street Journal, sales from NFT (non-replaceable symbols) are Collapse 92% from its peak, reached in September 2021 with an average of 225 thousand daily transactions. The average transaction is currently 19,000 transactions per day.

the number of Pocket wallet Active in the NFT market, which fell 88% last week, to a total of 14,000 wallets, in contrast to the peak reached in November 2021, when there were 119,000 active wallets. It also appears that interest in NFTs themselves is in free fall, at least according to google trendswith research on the topic down 80% since January, the peak month.

In short, the bubble The NFT appears to have exploded, either due to persistent frauds that have undermined the market to its foundations, or due to a lack of interest from the public, which sees no real advantage in buying tokens and which, in fact, often exists with a bunch of flies after spending them on NFTs.

It is possible that many of the early enthusiasts also calmed down and decided to look elsewhere, especially after realizing that their investment was worth nothing. For example, NFT from the first tweet in history, paid for nearly three million dollars by Sina Istavi, CEO of Bridge Oracle, receives very poor bids, a few thousand dollars. Even initiatives from the world of NFT video games, such as those of Ubisoft, Konami, and Atari, have not led to much, and for now, there are still isolated cases of resonance and success. In short, NFTs are likely to be the future, as it were Oya.

“Infuriatingly humble social media buff. Twitter advocate. Writer. Internet nerd.”