Spain was on the brink in 2012. Between rumors about the possible disintegration of the euro and growing international doubts about the true state of Spanish banking after the bursting of the real estate bubble, the Treasury did not lose its ability to finance the downturn. Huge public deficits hit markets, but investors demanded ever higher interest rates to part with their money. Even if it had managed to continue issuing debt, such an increase would have made public finances unsustainable, with a consequent suspension of payments by the state, so Mariano Rajoy’s government was forced to ask for help to the rest of the EU in June. 2012.

After arduous negotiations and in exchange for a demanding list of reforms overseen by the men in black in the Troika, the EU partners agreed to a financing line of up to 100 billion euros under more favorable conditions than Spain could obtain on the market. In the end, only $41.333 million was used, which was allocated to the rescue of BFA-Bankia, Catalunya Caixa, Nova Caixa Galicia, Banc de València, BMN, Ceiss, Caja 3 and Liberbank (all of which have now disappeared after being merged into other entities). . And also to finance the creation of SARB, the bad bank that received toxic real estate assets from the aforementioned funds, in red numbers that Europe forced the current government to add to the public debt and deficit in 2021.

“It didn’t cost a single euro.”

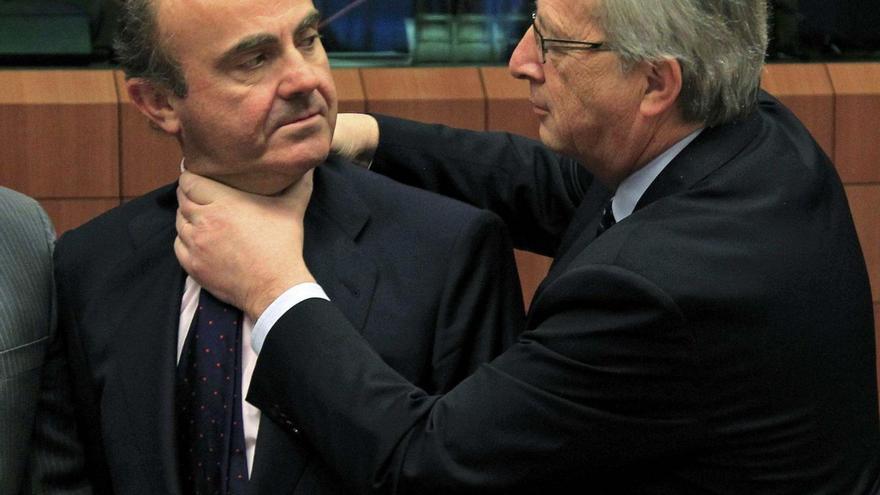

The then executive promised that there would be no cost to the state: this was confirmed by President Mariano Rajoy (“It is a loan to the bank that the bank will pay”); Vice President, Soraya Saenz de Santamaria (“This is done with one goal: not to cost taxpayers a single euro”); and then Economy Minister Luis de Guindos (“This does not cost the Spanish taxpayers”). But the truth is that the state had to repay the amount of 24.898 million that was already paid, in addition to about 3.276 million in interest and commissions between 2012 and 2023, and it will have to bear the remaining amount of 16.435 million, plus the corresponding interest and commissions. expenses.

The vast majority of the money invested has been lost forever or is difficult to recover in full. Thus, out of the 24.096 million euros contributed by two banks, about 6.340 million euros were considered redeemable at the end of 2022, although the stock market revaluation of CaixaBank – which the current government agreed to merge with the nationalized bank – raises this amount. On the other hand, the 2,192 million pumped into Serib were already considered lost, while out of the 32,610 million bailed out to other entities, 28,133 million were lost, i.e. 86.2%. If it had not evaporated, all that money would have made the bill with MEDE more favorable and would have facilitated fiscal consolidation.

At the other end of the scale, the European bailout was financially favorable for Spain. According to MEDE, the country saved about 1.2 points of GDP on interest until 2019 (about 12 billion euros) compared to the cost of getting money on the market in December 2012. Even with reference rates rising to 4.5%-4% promoted by the bank To combat high inflation, the average bailout rate rose from 0.8% last year to about 1.1%. In addition, the community organization pointed out that the banking restructuring that allowed the bailout is one of the fundamental reasons for the country’s economic recovery since 2014.

“Infuriatingly humble social media buff. Twitter advocate. Writer. Internet nerd.”