Markets are trying hard to pinpoint a potential inflation peak in an attempt to trigger a rebound, but the so-called technical bounce won’t change the underlying trend just started after years of bull market. Regardless of the Fed’s policies, the global economy has started its way into a recession scenario and Europe and the US have already been in recession for a few months. But the hope that recession will be an acceptable evil for the sake of not raising interest rates is that we don’t really understand what’s behind this crisis, which began without raising rates or initiating real restrictive monetary policies.

China has also failed to recover an acceptable pace of growth due to the global slowdown and real estate sector problems, raising the risk that the three most important economies on the planet will be mired in structural problems for an extended period of time. We are used to periods of violent and deep crisis (see 2001, 2008 and 2020) but they are also very short. Monetary and fiscal policies had ample room for maneuver to intervene to revive the cycle. But the room for maneuver today is very limited or almost none. While there is a tendency to think that markets are ready to absorb losses because they have already pulled back so much, in reality the fundamental picture has changed drastically and cracks in this failure appear in the private equity and leveraged sector.

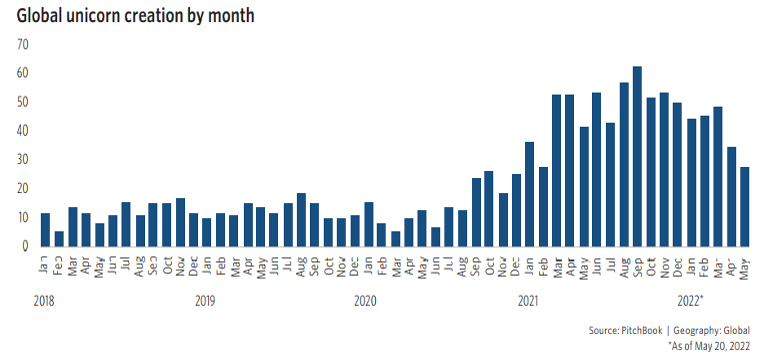

The latter is the main reason for the disappointing results of Wall Street banks that have surprised only sustainable speculative loans from the prospects of IPOs at stratospheric rates, and are now in strategic retreat on all fronts. The private equity activity of recent years has likely been the epicenter of a speculative bubble that has fueled the Nasdaq index and valuations of listed companies that never made a profit, but were bought out entirely by retail investors and mutual funds. From 2010 onwards, Wall Street banks simply shifted their speculative activity from 2006/2007 mortgage-backed securities to 2020/2021 leveraged loans. In particular, the past 3/4 years have been particularly intense for IPOs and the so-called Unicorns, companies with very high valuations and business models always at a loss.

{mfimage}

And so the banks, through Leverage Loans, financed the business of Unicorn companies owned by private equity funds, which ended up in the stock exchange with IPOs at crazy prices, expressing the anger of speculative stock market. Depositing in the stock exchange allowed private equity funds to collect significant capital gains and banks to recover from loans granted through leveraged loans. Many of these companies default within months of listing.

The activity was so intense that it spawned a speculative loan issue unprecedented in history. Today there is an estimated $1,330 billion in leveraged loans in circulation (equivalent to 6.5% of US GDP), which added to the $1,000 billion in high-risk private trust funds (5% of US GDP) and 30 % of subprime mortgages. Asset Returns (ABS), which underpin US consumer credit, are a much larger source of systemic instability than those from sub-prime mortgages in 2007. It is estimated that more than 30% of total credit outstanding in the US is either That through speculation or mortgage, the orgy unleashed by a central bank that hasn’t done its job in the last ten years, and as usual, in front of this process has gone out of sight.

So we look forward to the next recession to see how the problem of bankruptcies that is already emerging now, but well hidden in securitization tools as in 2006/2007, will be dealt with, in order to make people believe that the system is solid. This mantra is often repeated right before every crisis to urge investors not to exit the market. We’re also starting to see weird transactions between private equity firms, banks and mutual funds, with the first two brokers selling leveraged loans to mutual funds, potentially eager to buy high-yield securities for the end investors’ portfolios. I am afraid that the usual operating practices that precede the crisis of the system have already begun, but today, given the scale of the problem, they will not be able to lead to the usual bailout as in the past.

In fact, attitudes toward central banks seem to be changing. The Australian government has begun an audit of the Reserve Bank of Australia on how it handles the problem of inflation. The same is emerging within the US government, where a group of senators has begun to openly criticize the Fed’s forecasting capabilities on inflation and growth. In Japan, public opinion has begun to openly criticize the Bank of Japan for its deflationary policies and the devaluation of the yen. It is only the beginning…

The next crisis will be very different from what we have seen in the last twenty years. Governments will try to float the aggregate data as happened during the pandemic, but it will be an attempt that goes against public opinion of the reality of things. Central banks will be severely criticized for the conduct of monetary policies in the past years, and for the thousand failures to control system risks. Criticism of central banks will act as a brake on countless budget bailouts.

The economy, burdened with a huge amount of speculative debt in circulation, will suffer a prolonged stagnation, as we will not be able to absorb all the defaults needed to clean up the system at once. The prolonged phase of stagnation/stagnation, caused by the initiation of the so-called balance sheet stagnation very similar to that experienced in Japan in the 1990s, will lead to a significant correction in the stock markets (balance sheet stagnation is a type of stagnation economy that occurs when high levels of private sector debt to individuals or firms focusing on saving by paying down debt rather than spending or investing, causing a slowdown or decline in economic growth, ed.).

The quantitative easing policies of central banks have dragged the entire system into a speculative debt trap which, driven by a strategy of searching for yield, has been filled with only sustainable debt at zero interest rates. But zero rates are not enough, you also need a growing economy. Today, both fail. Therefore, I remain focused on the market targets already explained in the previous notes, which see indicative levels of 3500 for SPX, 12,000 for Nasdaq 100, 3200 for Eurostoxx and 12,000 for Dax. The markets may also perceive favorably the potential reduction in stagflation, but the stagnation or economic stagnation that awaits us will render the huge amount of speculative debt in circulation unpayable and this stagnation will begin in the balance sheet.

The long phase of deleveraging (reducing the level of debt of financial institutions) that we will have to face will be a phenomenon characterized by debt restructuring and bankruptcy, just as it did in Japan after the leverage boom of the 1980s. It will raise the market indices to levels much lower than those I indicated in the previous lines. However, we are currently awaiting developments in preparation to understand how the leveraged debt crisis will develop, which will extend to other speculative credit sectors.

The same problem occurs in China too, not with leverage loans but with credit to the real estate sector and this economy is also entering a balance sheet stagnation phase: the balance sheets of banks are four times the GDP and growth of the Chinese. The economy will never return to the previous levels as debt disposal in the real estate sector started. If anyone wishes to deepen the dynamics of a balance sheet recession on the economy, they can read the papers by Irving Fisher and, more recently, those by Richard Koo.

We’ll see if the Fed becomes a buyer of last resort as well for leverage and ABS, but if it does, that means that in the meantime, we hit bearish levels in markets that have nothing to do with those seen so far. Therefore, the Global Strategy Fund’s investment strategy remains geared towards maintaining significant short positions in the equity markets. However, the view on balance sheet stagnation is in line with the long-term deflationary impact on the global economy. For this reason, we started accumulating long positions on 10-year US and German bonds. Gold, despite various attempts to manipulate it by the US authorities, remains a long-term, long-term center in a context that will be marked by a solvency crisis of the massive stock of speculative debt accumulated in the system in years of the center’s outrageous quantitative easing. banks. (All rights reserved)

Novelli is the director of the Lemanik Fund for Global Strategy

“Prone to fits of apathy. Introvert. Award-winning internet evangelist. Extreme beer expert.”