With a surprising acceleration compared to the rumors, the Kkr Fund announced its intention to launch a takeover offer Tim Which can again change the assets of the previous monopolist. Yesterday, TLC’s board of directors took note of the proposal, which, if accepted, provides for a payment of 0.505 euros per share, which is 47% more than the market value set on the stock market last Friday and 60% on an average of thirty days. But other international funds, such as CVC and Advent, could also enter the field at Tim, competing with Kkr.

general information

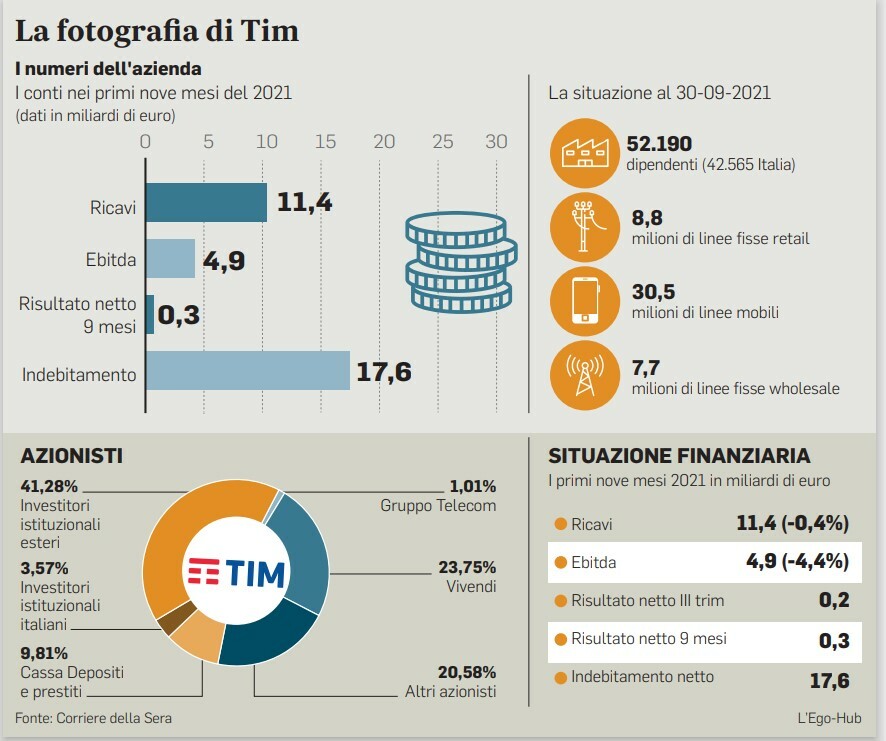

In a letter a few days ago to President Salvatore Rossi, the US fund, headed in Italy by Alberto Signori, already with one foot in Tim’s group through 37.5% in Fibercop, expressed its “friendly, non-binding and indicative” interest in acquiring 100% of common and savings shares For the group through a conditional offer of access to 51%. At a proposed value per share, Tim would be worth $11 billion. Yesterday afternoon, the urgently called extraordinary council, which lasted less than four hours, took note of the proposal “based on information in the public domain”. For this reason, Kkr has set out among the conditions for the launch of the offer, as well as “the approval of the company’s directors and management support”, as well as “the performance of confirmatory due diligence for a period of four weeks”. As a “approval of the relevant corporate subjects” because “the company is subject to the special powers of the golden authority exercised by the government.”

The Board of Directors would not have expressed itself about the indicative price, because it will first have to deal with the substance of the remarks made to Luigi Gubitosi on the performance and strategies of the company through letters of committees, directors and mayors. It will be discussed in the Extraordinary Board of Directors on Friday the 26th. Yesterday, two French advisors (De Boifontaine and Cadoret) and three independent directors (De Meo, Falcon and Moretti) pressured Gubitosi to buy time on Kkr while the CEO instead wants to tighten his time with the fund. When the first calculations are made, the price is 0.50 euros less than the book value of Vivendi (0.80 euros) and Cdp (0.55 euros). However, Cassa Depositi, who on Thursday 25th will present the new plan, has an institutional role that goes beyond the expected economic comfort over network protection, in tandem with the golden power of government.

The reason for the price, which some analysts consider inappropriate, lies in the fact that before considering a possible adjustment, Kkr intends to carefully study the accounts of the group, as is known from two warnings about earnings and with a rating downgrade by S&P. The final decision will also depend on the performance of the stock in the stock market starting today: it will almost certainly move as well with respect to the strong overdraft that characterizes it. “Vivendi reiterates its willingness and willingness to cooperate with Italian authorities and public institutions for the long-term success of Tim,” a spokesperson for the French group said in the morning, describing itself as a “long-term investor”. This means that Paris has not given up, and there are those who believe that it can finally organize a counter-offer.

Georgian flag

As for the ever-strained relations between Vivendi and Gubitosi, a rumor circulating yesterday in circles close to the French about the genesis of the Kkr operation should be recorded that the manager is somewhat directly interested in the US fund’s move. In fact, it is said that after a difficult confrontation in Paris with Vivendi’s top management over the past few weeks, Gobitossi had requested Kkr’s intervention thanks to the good relations he had with his top management, given that he had finished in August 2020. With them and they signed an agreement to allow them to enter Ras FiberCop subsidiary money. If true it would be dangerous, even if no objective evidence has yet been shown. The fact remains that, according to government rumors, in recent days, Kkr informed Mise of her intentions, so much so that the owner Giancarlo Giorgetti was going to give an interview about the proposal with Mario Draghi, and, on the other hand, with the Minister of Economy, Daniel Franco.

© Reproduction reserved

“Infuriatingly humble social media buff. Twitter advocate. Writer. Internet nerd.”