Central Bank of the United States

In a previous article we explored the European Central Bank; Today it’s the turn of our overseas colleague, the Federal Reserve Bank (also known as the Fed).

These institutions play a central role in a country’s monetary policies. Their decisions have direct consequences on the economy and finances, as well as people’s lives.

Knowing what the Federal Reserve is is also important from an investment perspective: by knowing its areas of work, we have the opportunity to understand in advance what could happen after the decisions made.

Let’s not delay any longer and enter the world of the Fed.

What is the Federal Reserve Bank?

the Federal Reserve Systemusually abbreviated to Federal Reservebut for “friends” also known as Nourish itand the Central Bank of the United States of America.

Founded in 1913This more than a century-old institution has lived and encountered all the pages of history that marked the twentieth century and the beginning of the new millennium. Let’s talk about events like The Great Crash of 1929followed by Big disappointmentenergy crises, even The Great Recession Started in 2007.

A succession of appointments throughout history has brought greater responsibilities and authority to the Federal Reserve, which today is one of the major champions of American and global economic life.

The Federal Reserve owes its birth to the verb of the same name (Federal Reserve Act), through which the US Congress determined its main tasks. Like any central bank, the Fed should seek to achieve the following objectives:

- Ensuring price stabilityIntervention, if necessary, to address abuses (including inflation);

- tightly connected, Maintaining sustainable interest rates over the long term For all actors involved;

- Promoting the best conditions for the labor market.

but this is not all. The Federal Reserve supervises banks and tries to position itself as a reference point in the economic panorama.

It is a prestigious entity with enormous power, which can determine the fate of the country’s growth. Moreover, since the United States is the United States, the Fed’s decisions also have ramifications for the rest of the world.

Structure of the Federal Reserve

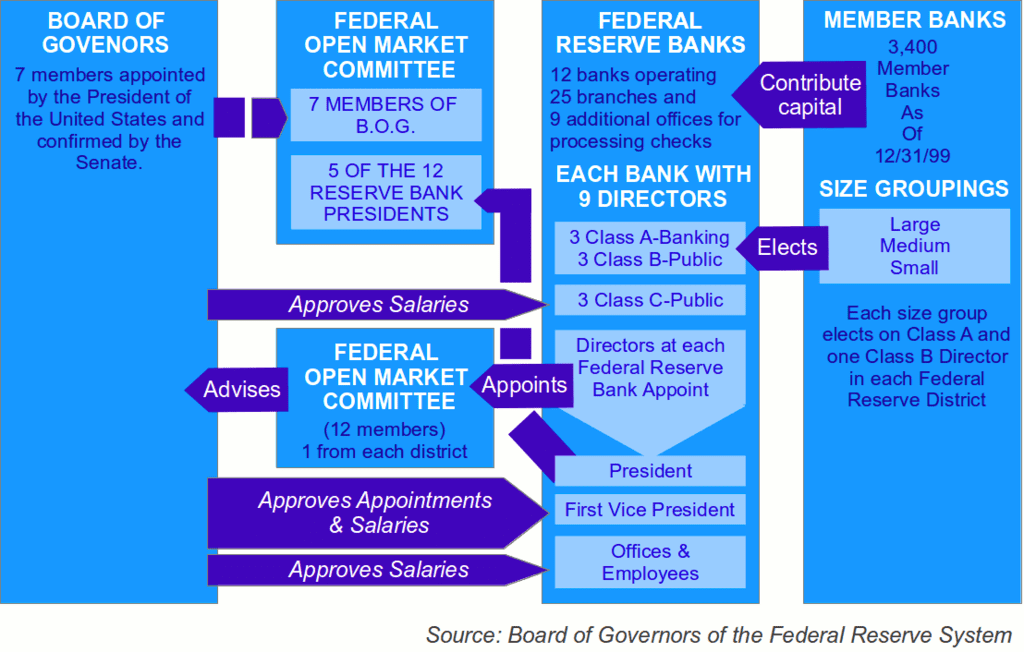

there Structure of the Federal Reserve System It is very complex and relies on four main blocks:

- Board of Governors;

- Federal Open Market Committee (Federal Open Market Committee);

- Regional federal banks (12 in total, located in some of the most important cities in the United States);

- Member banks.

picture: Kimse84 from Wikimedia Commons

the Board of Governors It is a seven-member federal agency. The main goal is to supervise banks and public areas. Furthermore, the Board sets monetary policies.

To join the Board, you must obtain the position directly from the President of the United States, as well as be confirmed by the Senate.

the Federal Open Market Committee It is a key committee from a macroeconomic perspective. We must know him well, because every forty days or so we wait impatiently for what he will decide regarding US interest rates. For more information, here is an article dedicated to the Federal Open Market Committee.

the Regional federal banks They have direct responsibility over their regions, as well as the member banks that operate within them.

the Members of the Federal Reserve System They are banks spread throughout the entire national territory. It is a private institution, with each member owning shares in their own regional FED bank. Just under 40% of U.S. banks are also members of the Federal Reserve System.

Where is the Federal Reserve located?

The headquarters of the Federal Reserve Bank is located in Washington, DCwithin the iconography Eccles Building.

But as we know, the Federal Reserve is a system, so the regional offices located across the country are different: up to 12 in number.

Among the major cities that will be questioned are Chicago, Boston, New York, San Francisco and Dallas.

“The picture on the cover depicts the Eccles Building.”

Who is the head of the Federal Reserve?

Republican Jerome Powell And the Chairman of the Board of GovernorsIt is the most important position in the Federal Reserve System.

Born in 1953, Powell is a lawyer and banker with an enviable CV.

After graduating in politics from Princeton University, then majoring at Georgetown University, in the 1980s, he shifted his focus to the investment sector.

In 1992 it became Undersecretary of the Treasury for Internal Financial Affairs During the era of President George H.W. Bush. And in the meantime he was Partner of the Carlyle Groupa large asset management firm he left in 2005.

In the 2012 I became a part of Board of GovernorsThen he is elected President V 2018Under the Trump administration.

We all know the latest story: the coronavirus, the stimulus and subsequent inflation, which will require interventions for which Powell bears much of the decision-making responsibility.

“Jerome Powell is Chairman of the Federal Reserve”

Now that I know her…

…You know you’ll have to pay close attention to upcoming Federal Open Market Committee (FOMC) meetings and updates from the Fed world.

We conclude with a note: Let us not confuse this institution with the Securities and Exchange Commission, that is Securities Trading Commission. The latter has authority over financial markets, but in no way can it express opinions (nor make decisions) regarding the economy and monetary policies.

“Prone to fits of apathy. Introvert. Award-winning internet evangelist. Extreme beer expert.”