The Revenue Agency publishes the draft circular of the new budget law

A draft circular published by the Revenue Agency on 15 June 2023 is available for consultation.

Provides clarification Tax treatment of crypto assets Referred to in Article 1, paragraphs 126 to 147, of the Law of December 29, 2022, n. 197 (2023 Budget Law).

Interested parties have until June 30, 2023 to submit their comments and suggestions for changes or additions.

The purpose of the advisory is to allow revenue to evaluate contributions sent, for their ultimate purpose Implementation in the final version from generalization.

Here you can See the entire new post.

Contributions must be sent to the email address [email protected]

To ensure the efficiency of the process of merging the various contributions, interested parties are invited to it Follow the chart below:

- objective

- generalized paragraph

- note

- Input

- very.

Once the public consultation phase is completed, the Revenue Agency Comments received will be publishedexcept for those containing an express non-disclosure request.

Most prominent generalization

Some are dealt with within the circular Important pointsany:

- Legal Framework – Classes and types of crypto assets

- tax system door Budget Law 2023

- tax system mail Budget Law 2023

- Crypto Asset Revaluation (Revaluation) with Alternative Tax Payment of 14% Extended to September 30, 2023

- Crypto Asset Regulation (Pardon) (Judgement is Made)

- Commercial income

In the draft of the publication, which is not less than 100 pages, it comes necessarily Certain The Revenue Agency’s own interpretations regarding the tax system door budget lawaccording to which cryptocurrencies were absorbed into foreign currencies that have legal tender.

The aforementioned setting comes completely crooked Rather under the new budget law, under which the now-defined “crypto-assets” are classified under various incomes in art. 67 Paragraph 1 above. c-sexies) from TUIR.

Tax issues in the new budget law

As we noted in detail when we introduced the new budget law on cryptocurrencies, the specific “crypto assets” are now classified under different incomes in Art. 67 Paragraph 1 above. c-sexies) from TUIR.

Effectively defines the new budget law 4 different tax issues:

- pay off crypto assets (eg bankruptcy);

- Conversion to consideration (conversion in euros);

- exchange of crypto assets (only between crypto assets that do not have the same characteristics and functions);

- Other income from holding (such as betting).

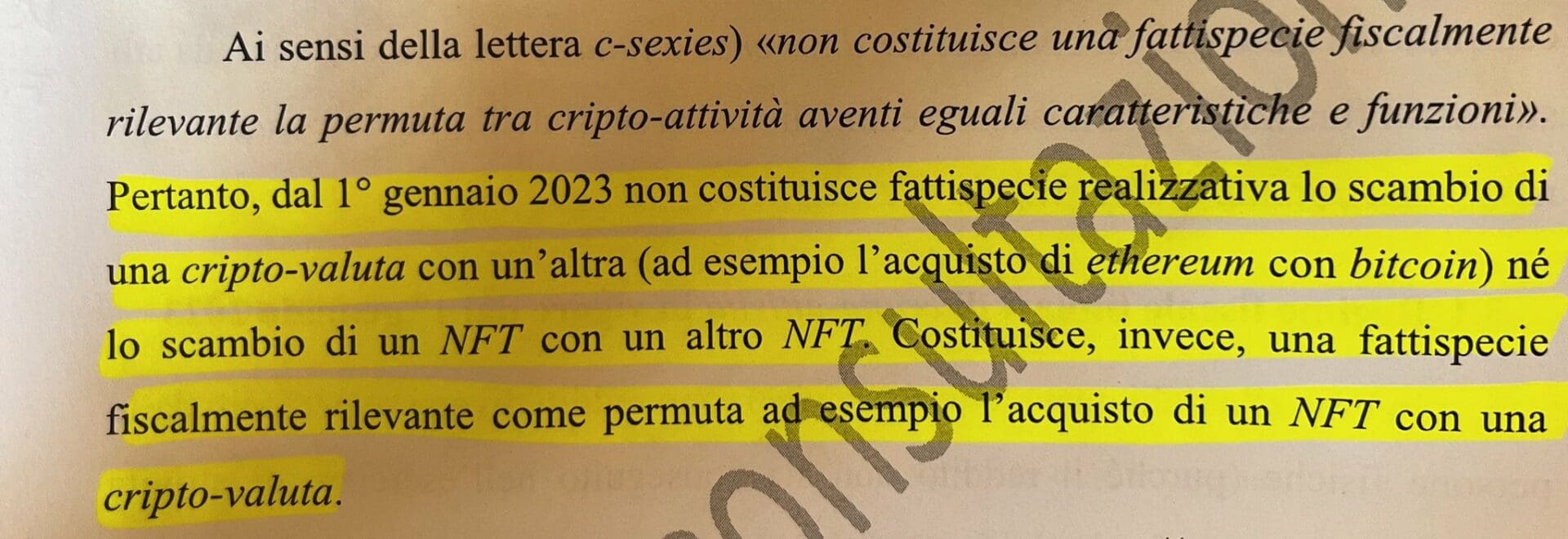

The salient theme is definitely what to do with swapor a crypto-asset exchange, given that the law specifies it “An exchange between crypto assets that have similar characteristics and functions does not constitute a financially relevant issueWithout defining what is meant by the same properties and functions.

The interpretation suggested by the Revenue Agency, in the draft document of practice in question, is that accordingly exchange one cryptocurrency for another (“eg buy Ethereum with Bitcoin”), While the exchange between cryptocurrency and NFT is a case of investigation.

Let’s dive into the topic in a live broadcast with the expert

This contribution was written by Dr. Andrea Russoan expert cryptocurrency accountant with an office in Bologna.

Next Tuesday we will be hosting a live broadcast where we will explore new cryptocurrency tax issues on our YouTube channelDo not miss it!

For completeness, I also leave you the contacts of the Andrea Russo brand: cryptovsk.

See you Tuesday!

“Infuriatingly humble social media buff. Twitter advocate. Writer. Internet nerd.”