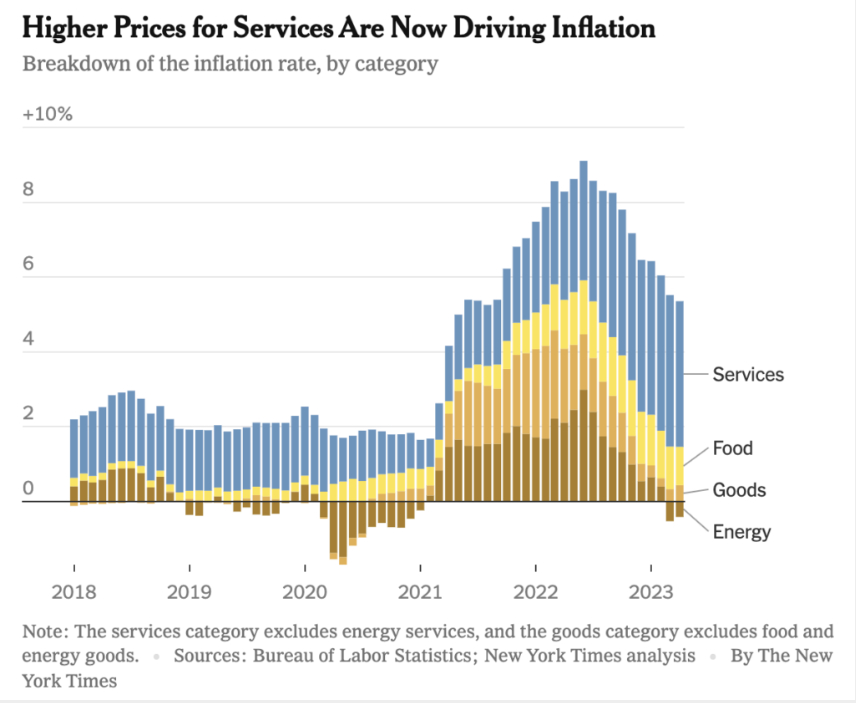

The “good news” is that inflation in the US has subsided, which supports a “potential” pause in interest rate hikes.

The CPI rose 4.9% year-over-year, marking its first “low” reading in the last two years, and I expect it to continue to fall at a more reasonable 3% over the next 12 months, versus 2%.

The Fed will also need to see more than one number to make sure they are in contraction. Before the next meeting, FOMC members will have May CPI, labor market reports and PCE.

Meanwhile, markets expect cuts by the end of the year.

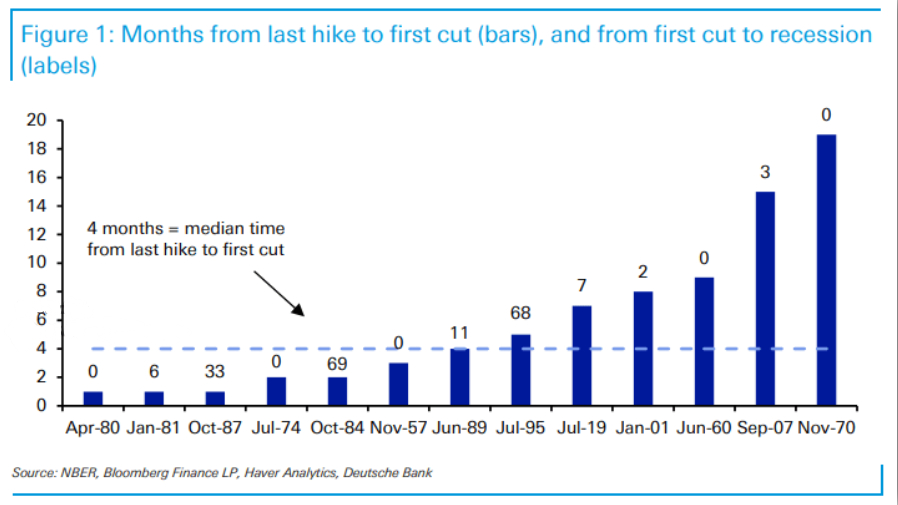

But how long does it take from the last rate hike to the first Fed cut?

Historically, about 4 months pass between one central bank action and another, with a possible recession (severe or moderate).

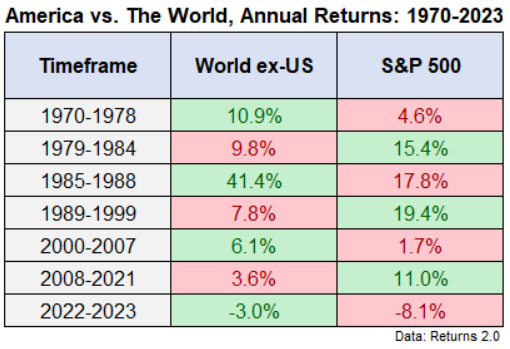

So, is “international diversification” still applicable in terms of investments, today more than ever?

The United States “accounts” about 60% of the world stock market by capitalization, and let’s say “a lot” depends on it. Many investors often do not even look at other markets and prefer to own only US stocks. But it’s still worth “considering” diversification from a geographic point of view in the long run, not just in light of macro issues, by comparing past MSCI World data to the USA since 1970, where annual performance for both indicators fluctuates from +9% to 10.5%.

Accordingly, thinking that “US stocks have always had high returns” is a bias.

MSCI World’s Annual Returns Outside the US vs. the S&P500

It is of course possible that a portfolio based solely on US stocks will do well in the long run, but also a good percentage that US stocks themselves can underperform international stocks. This is the “main” reason to own diversified portfolios, knowing that in this way you can get “good enough” returns to avoid potential negative returns on a particular asset or basket.

Could a similar discussion be held with IPOs?

In recent years, only a handful of US companies have, so far, had a value above or close to their initial “prices.”

Uber (NYSE: May 2019) $82,400 – Today $76,400

Rivian: Nov 2021 $66,500 – Today $12,595

Coinbase (NASDAQ): Apr 2021 $65,000 – Today $13,660

Airbnb: Dec 2020 $47,000 – Today $75,555

Snowflake (BIT :): September 2020 $33,200 – Today $50,100

Snap (NYSE:): March 2017 $33,000 – Today $13,180

Robinhood: July 2021 $32,000 – Today $7,930

Pinterest (NYSE): April 2019 $12,660 – Today $14,330

Together, these companies’ valuations are down more than 40%. Some of the stocks that have seen billions in market capitalization “drained” are Rivian, the EV maker that had the biggest IPO of 2021 and Coinbase, which debuted in 2021, the crypto platform that’s down 84% from its initial price.

On the other hand, we remember such IPOs as Aramco (Tadawul :), Alibaba, Enel (BIT :), Meta and many others, which today have place values.

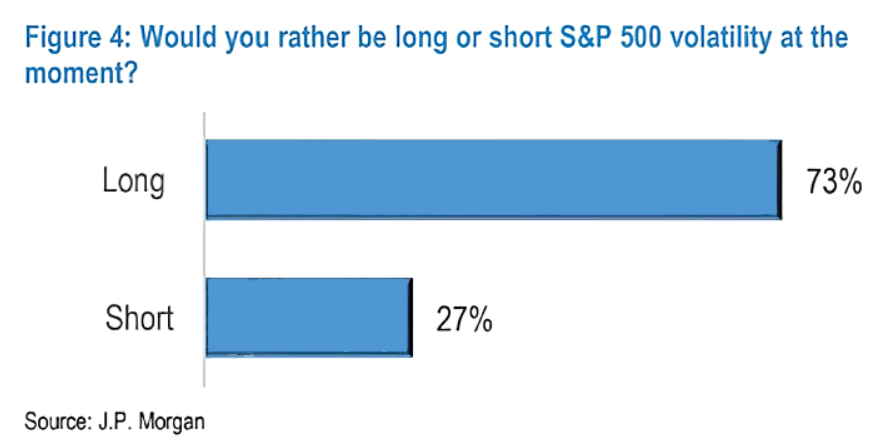

Meanwhile, in the next few months, clients of JP Morgan (NYSE: 73%) would prefer to stay “long” on the volatility of the US index, the S&P500.

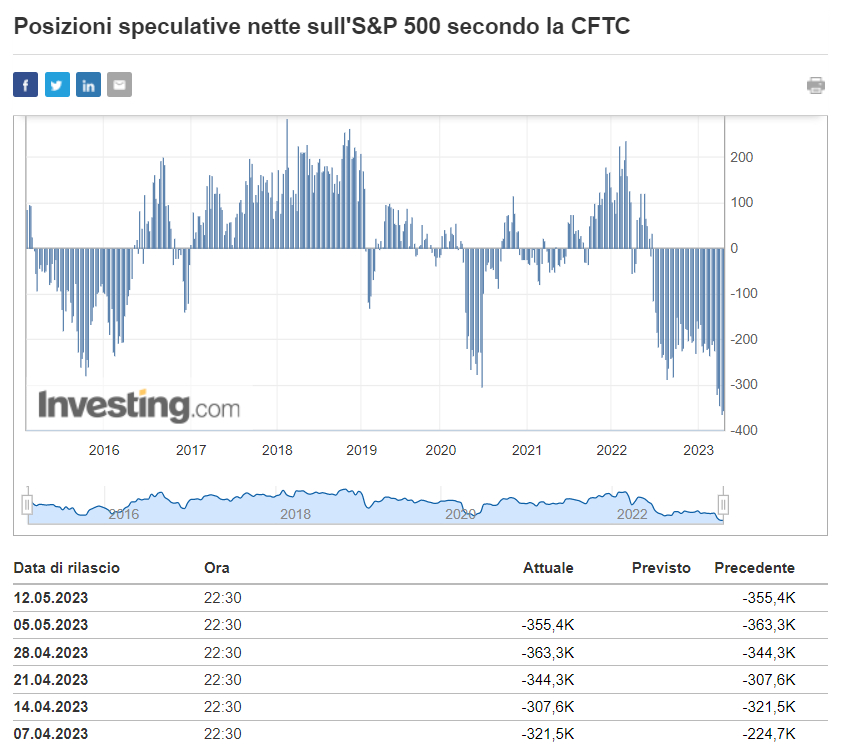

As a result, they expect it to go up, even though the VIX fell today (16 points), which sent stocks lower. The same is true of COT which provides a detailed analysis of the net positions of “non-trading” (speculative) traders in the US futures markets.

According to recent data reports, traders “believe” that the market is ready for a downturn. And compared to the previous survey by JP Morgan, the interesting thing is that such a “clear” negative situation is a contrarian sign. Net short positions in the COT data are as low as they were in 2007 – 2011 – 2015 – 2020. Does it protect long positions in portfolios from a drawdown?

However, from 2007 onwards, conspicuous short positions (in some cases) not only sealed the market’s bottoms, but provided fresh “fuel” for a sustained rally.

Are you being placed in a short or long position?

Until next time!

In order not to miss my analytics, receive updates in real time, click the button [SEGUI] from my profile!

This article has been written for information only; it does not constitute a solicitation, offer, advice, advice or investment recommendation as such and is not intended to encourage the purchase of assets in any way. I remind you that any type of asset is evaluated from many points of view and is involved It is highly risky, and therefore, every investment decision and associated risks remain the responsibility of the investor.

“Prone to fits of apathy. Introvert. Award-winning internet evangelist. Extreme beer expert.”