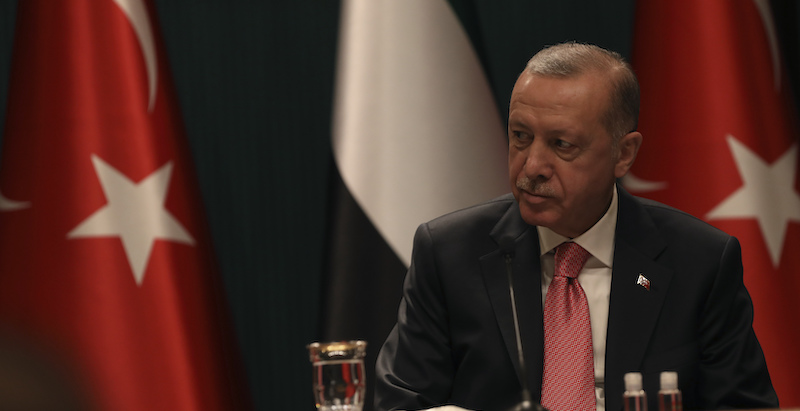

Turkish President Recep Tayyip Erdogan on Monday announce His government will compensate account holders in Turkish banks who will be affected by the loss of the value of the Turkish lira. This announcement was considered very reassuring by international investors, given that Erdogan actually promised that the money that Turks deposited or invested in Turkish lira in national banks that they would lose due to the devaluation of the lira, would be compensated by state reserve funds.

Monday is the latest in a series steps Very turbulent for the Turkish economy, a story that has been going on for several months.

The day before Erdogan’s announcement, the Turkish lira reached one of its lowest levels against the dollar: on Sunday, it took 18.36 Turkish liras to buy one dollar. After the speech, the exchange rate fell to about 11 Turkish liras, while the exchange rate reached about 11 Turkish liras financial times He knew “The most volatile day for the Turkish lira since the 1990s.” In 2019, it took about 6 Turkish liras to buy one dollar.

So by the time the markets closed (including in the US), the Turkish lira had seen a significant increase in value, now settling at 13.49, down all the way from 18. Erdogan supporters chant victory. I’m not sure how it was done, but if this was a victory, I don’t want to see what a defeat was. pic.twitter.com/YdYpDxMPPt

– Louis Fishman Louis Fishman (@Istanbultelaviv) December 21, 2021

In recent months, the depreciation of the Turkish lira has been caused by extremely high inflation, now estimated at 20 percent, which in turn resulted from the huge amount of money being distributed by Turkish banks. The latter was a direct result of the decisions of the Erdogan government, which has always been convinced that in order to revive the economy, banks must keep interest rates at a minimum, which makes it very easy to apply for loans and mortgages.

Erdogan justified his decisions with the Islamic faith, which severely punishes usury (that is, the demand for high interest rates for loans).

Many economists have argued that these decisions can increase inflation, that is, higher prices of goods, and put consumers in more difficulty.

According to analysts cite iteconomicInflation is expected to reach 50% in the first months of 2022. But the depreciation of the Turkish lira has also gradually convinced many Turks to withdraw their deposits and investments in Turkish banks to convert them into considered more stable currencies such as the dollar, which has put banks in a difficult situation .

– Read also: Is inflation transient or not?

German wave He writes The hypothesis of many foreign diplomats is that Erdogan is trying to revive the Turkish economy quickly to reach a good consensus in the next political elections scheduled for 2023.

“Infuriatingly humble social media buff. Twitter advocate. Writer. Internet nerd.”