we are here. The long awaited day has finally come. Investors will now be able to better understand the future of the markets and the path of the Federal Reserve (Fed), thanks to a reading of the data on consumer price growth, expected at 14:30 CET. A value that, at its last reading in March, reached its highest level in December 1981, at 8.5% year on year. A possible slowdown in April to 8.1% y/y is forecast, if confirmed, could ease market pressures at a 75 basis point rise in June. Regarding the path on higher interest rates, yesterday Loretta Mester (Cleveland Fed President) noted how the Fed is evaluating a half percentage point increase in June (and July), in order to better understand the path according to the data received. Regarding concerns about the side effects of a rate hike, Christopher Waller (Director of Research at the St. Louis Fed) stated that the increase would not have a significant impact on unemployment. Returning to the topic of inflation, any potential slowdown could give a sigh of relief to the markets especially technology stocks, which are moving at -24.35% from the start of the year.

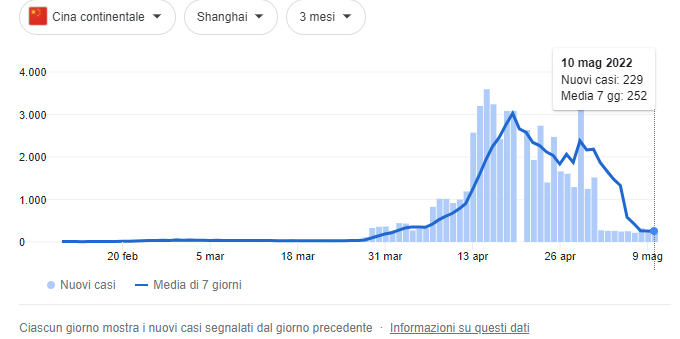

The Asian session brings us mixed news, but above all it explodes with optimism, as many of its indicators are trading in positive territory. On the one hand, consumer price inflation in China accelerated to 2.1% in April, from 1.5% in March, marking the highest reading since last November. However, it is still within the PBoC’s 3% target for this year. On the other hand, pressures on producer prices eased, with the April reading of 8%, down from 8.3% in March. The positive news is that new Covid-19 infections are declining in Shanghai, a city that has been grappling with a six-week lockdown, and above all, no new cases have been reported outside the quarantine areas. The data, recent, generated some relief in the hope of a possible future relief on the city. The closure on Shanghai that Elon Musk discussed with the Beijing government, where, according to the statements of the American businessman, the restrictions are about to be removed.

European gas is once again at the heart of concerns in Europe. Ukraine has already reported the closure of the Russian gas transit through the Sukhranivka route, as occupying forces control the breakaway Luhansk region. The news is significant because about a third of Russian gas passes through Ukraine to Europe, and its transit through Sukhranivka accounts for about 27%. While the Ukrainian system operator has reported that gas can be redirected to Sudzha (the other transit in Ukraine), Russia’s Gazprom denies this hypothesis. News that European gas prices are warm, with the Dutch TTF trading in the region of €100 per megawatt-hour. Weather forecasts of warmer temperatures and an abundance of LNG prevent prices from rising.

The Cryptocurrency and DeFi market is fighting its real battle with UST, the stablecoin of . The token, which rose to fame due to an interest offer of around 20%, is still losing the battle over PEG, with current prices seeing the token at $0.3924. Caporetto for a stablecoin, currently very far from parity with the dollar. Being a (crypto) currency, earthly vaults cannot be immune to speculation as to its reliability. As in the real market, we have seen attacks on the British Pound, the Swiss Franc, the Italian Lira, and even the Terra (UST) stablecoin, in recent days, in the same center of attention, having lost their ground against the Dollar. Today the central bank is not the Bank of England (BoE), nor the Swiss National Bank (SNB) or the Bank of Italy, but rather an algorithm. Unlike many stablecoins, such as USDC or BUSD, Terra’s UST is an algorithmic stablecoin, which means that instead of being (apparently) 1-1 backed by different assets, it relies on an algorithm that uses different market incentives to maintain at a specified price. Just as with the Bank of England trying to defend itself against George Soros and his allies, the $0.98 Moon Foundation Guard (LFG) set a point to defend, swim against the tide and fight a losing battle from the start, even though LFG liquidated $1.3 billion in reserves to try to restore the peg . The ensuing bitcoin sell-off to buy back terrestrial treasuries had a disastrous effect on the cryptocurrency market as the price of bitcoin plummeted as well.

Remember how Terra (LUNA) represented the second largest ecosystem by total locked value (TVL) in DeFi, at about $16.8 billion. The ecosystem operates with two tokens: UST and LUNA. UST is, as mentioned, a stablecoin pegged to the US dollar in a 1:1 ratio, while LUNA is the governance symbol. The entire ecosystem is built around the UST stablecoin. To create more floor cabinets, you have to copy LUNA (which means the token is deflation). By blocking your floor cabinets, an annual return of 19.5% (APY) was also possible. An important return that led to a higher demand for the token and thus an increase in the value of LUNA.

Gabriel Dibash

Italian Market Analyst eToro

Not giving an opinion:

The content of this prospectus is informational and educational in nature and cannot be considered as financial advisory activity or as an investment recommendation.

Past performance is not an indication of future performance. Trading is risky and it is recommended that you only risk the capital that you are willing to lose.

The price of cryptocurrencies can vary greatly and is not suitable for all investors. Cryptocurrency trading is not supervised by any EU regulatory framework

“Prone to fits of apathy. Introvert. Award-winning internet evangelist. Extreme beer expert.”