The Biden Administration, through the Treasury Department, has updated the Access to Tax Incentives provisions of the Inflation Reduction Act: No subsidies for companies in the United States that use components or materials through suppliers or affiliates of Chinese entities (Foreign Entity of Concern). Move towards reducing risks.

While the intense days of the Cop28 conference are being held in Dubai, aiming to advance climate diplomacy to achieve the goals set in the Paris Agreements, the United States continues to see the energy transition not only as an opportunity for growth and development, but also through the lens of geopolitical competition.

A belief gained from the framework in which the People’s Republic of China controls a large part of Suppliers From mining to the most advanced components, lithium-ion batteries are a central technology for decarbonizing transportation and stationary energy storage.

Since the passage of the Inflation Reduction Act (IRA) in August 2022, a pro-climate legislative measure and part of the Biden administration’s broader industrial strategy to strengthen the country’s position in this emerging industry, nearly 80 new projects related to the electric battery supply chain have been announced in the United States. With private investments amounting to about $80 billion. But it’s not just about the copious use of public investments: the IRA is a complex bill, created after a careful analysis of monetary policy. Suppliers To understand US vulnerabilities, especially with regard to supplies of important raw materials such as lithium, nickel, graphite and basic materials for manufacturing battery components, which are currently dominated by Chinese, Korean and Japanese companies.

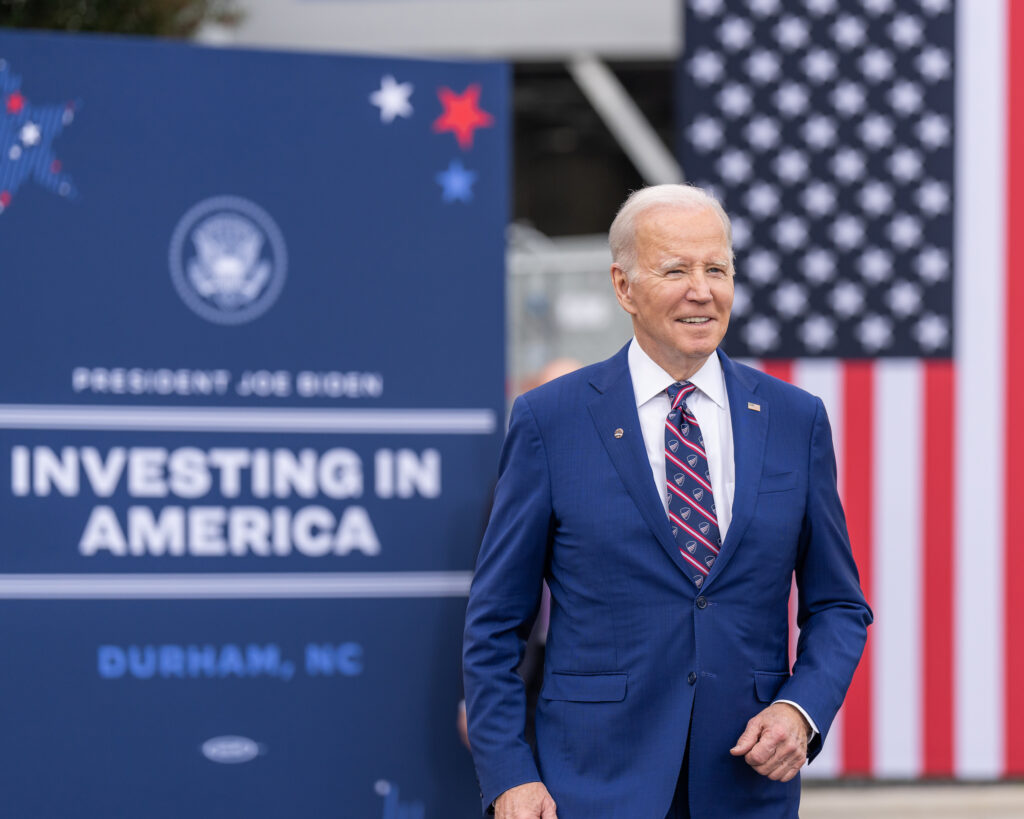

Specifically, in an attempt to decouple this industrial geography, built around production networks that gravitate around China – which we remember is the world’s main electric vehicle market – with the aim of stimulating American demand, the Biden administration has envisioned a series of provisions, without ever mentioning China directly in This ruling. Towards the end of December 2022, US Department of Treasury Important has been released White papers Regarding the possibility of expanding tax incentives provided by the Internal Revenue Authority – The measure, signed by President Joe Biden a year ago, stipulates that electric cars and Extras Hybrid vehicles sold in the United States must meet requirements for critical materials (lithium, nickel, cobalt, etc.) extracted or processed on domestic soil or in countries with which the United States has a Free Trade Agreement (FTA) in order to receive the $3,750 tax credit. Even on countries with which the United States does not have a free trade agreement, such as the European Union.

Standard of important materials processed at home I was finally relaxedWith a 50% tax break for car purchases ($7,500) provided if suppliers process 40% of the added value of materials even from non-FTA countries. Obviously, raw materials and materials of Chinese origin cannot qualify directly, specifically with the aim of limiting Chinese supplies while at the same time encouraging Suppliers substitute. However, it was known to many analysts that these provisions should eventually conflict with the reality of the facts: as expected, several large Korean and Japanese industrial groups, such as LG Energy Solution, Samsung SDI and Panasonic, have developed a powerful system. Interdependence with Chinese material suppliers, especially lithium products and processed graphite (used in battery cathodes and anodes respectively).

Since the existence of a free trade agreement between Korea and the United States qualifies Korean companies that produce batteries and components to be able to benefit from American subsidies and thus invest on American soil, this deeper trade integration with China has led to the revision of another provision stating that it has already been introduced into Legislative measure. It is a tool that, in contrast to those designed for advanced semiconductors in which American technology plays a central role, seeks to limit the dominance of Chinese technology in batteries.

US Department of the Treasury and Internal Revenue Service (IRS). I’ve posted a suggested guide To the provisions of the electric vehicle tax credit contained in the IRA. This guide provides more clarity on the rules regarding so-called A disturbing foreign entity (FIOC) is stipulated in law. The FEOC requirements, which are divided into two parts, stipulate that for each half of the $7,500 credit, any vehicle placed into service in 2024 cannot have battery components manufactured or assembled by the FEOC, and starting in 2025, cannot It contains important minerals that are extracted and processed. Or recycled by Feoc.

| Requirements to access EV credit | 2024

(to get $7,500) |

2025

(to get $7,500) |

| Foreign entity of concern (battery components) | Yes | Yes |

| Foreign entity of concern (critical minerals) | no | Yes |

| Percentage of ingredients | 60% | 60% |

| Percentage of critical minerals | 50% | 60% |

table 1 | Summary of requirements for electric vehicle tax credits under the Inflation Reduction Act Source: US Department of the Treasury

But what is the legal definition of Feoc? The document provides an explanation, the main part of which is as follows: “The term foreign entity of interest means a foreign entity that is owned, controlled by, or under the jurisdiction or direction of the government of a foreign country that is a covered country.”

the Covered nations For the United States, there are four: China, Russia, Iran, and North Korea. The document stipulates that the threshold for determining whether an entity has ownership or control over an industrial asset (raw materials, materials, or components) is 25% or more of the board seats, voting rights, or shareholder interests in the company. The entity held cumulatively by any entity classified as a Feoc. An entity incorporated or headquartered (HQ) in a covered country will also be classified as a FEOC. Furthermore, it is well established that licensing agreements or other contractual agreements (such as supply agreements for biomaterials) can also be absorbed into forms of control. This means that these agreements signed in the United States or elsewhere would prevent vehicles that use these components or cells from qualifying for the IRA EV Credit. Finally, a certain margin of discretion has been suggested regarding “untraceable battery materials.”

The new items are announced in the context of the refrigeration market. In China, lithium prices have fallen more than 70% this year, with prices for lithium hydroxide (a key chemical byproduct used in batteries) falling to an average of $17,350 per ton in Benchmark Minerals Intelligence’s latest assessment. The persistent supply and weak demand for electric vehicles are factors that have contributed to this downward trend, which seems to favor Chinese battery and car manufacturers that are willing to further attack international markets at the expense of their competitors.

Overall, what emerges from the document is a strong political will to set stricter limits on the participation of Chinese companies in emerging economies. Suppliers for electric batteries in the United States. It is a move that could affect not only access to important minerals processed by China, but also a series of Chinese-derived technologies such as lithium iron phosphate (LFP) batteries, considering that even trade agreements (such as those between Ford and Catel) : Now a hypothesis com. gigafactory In Michigan may hesitate) will be subject to close scrutiny.

And to a large extent, it is the big North American auto giants like Ford, General Motors and Tesla itself – which will be highlighted, given their very strong coexistence with suppliers and big Chinese battery giants like CATL – who will want access to all the tax credits. The IRA ($7,500) will soon ensure that the batteries installed in their vehicles do not contain metals or components supplied by a company that is at least 25% owned by a Chinese entity. Additionally, all EVs not assembled in North America will be excluded from the incentives.

The now clearer definition of Feoc will be welcomed with great support by the US political class, led by Senator Joe Manchin, who has often drawn attention to the need to adopt more concrete measures to limit Chinese penetration into the batteries it wants to define. Itself Made in USAAmerican society has benefited from it – and with partial support.

From an international point of view, this measure could be a strong incentive towards the regionalization of the region Suppliers, with a rush of companies that do not want to miss the IRA opportunity to invest in countries with which the United States has concluded a free trade agreement and above all in line with anti-China clauses. This aspect will be particularly difficult, since the bulk of the supply of raw materials and critical materials such as lithium, cobalt, nickel, manganese and graphite is directly supported by production in China or other countries (such as Chile, Congo and Indonesia). Companies controlled by Chinese entities are particularly entrenched in those markets.

But there are also differing opinions. According to initial feedback from analysts, a 25% ownership structure may be too low to be used as a trading shield. A higher percentage would have forced FEOC entities to invest, jointly with domestic companies, in FTA countries to extract materials and ship them to the United States in order to qualify for the IRA credit. “At a time when China is using massive subsidies to undermine American manufacturing and seize global markets for battery components.” accusation mike gallagher, Wisconsin Congressman H president By the House Committee on the Chinese Communist Party, “the Treasury Department’s naive new rules would open the floodgates to Chinese companies profiting from American taxpayer money.”

Alliance for Automotive Innovation (AAI) lobby The industry group, which includes the majority of US auto manufacturers, expressed a positive opinion on the measure, especially given the nearly two years remaining for manufacturers to adapt to the expected new provisions for the supply of critical materials. It remains to be seen how and whether the rules will change if a Republican president takes office in the White House a year from January 2025. Automakers Americans, which increases the need to align, in the short term, with the country’s industrial security needs. This will also require big European players – such as Stellantis, which recently signed an agreement with Catl to equip LFP batteries in its vehicles – to take this into account if they want to access the US market.

“Prone to fits of apathy. Introvert. Award-winning internet evangelist. Extreme beer expert.”