Unemployment and Markets in the United States

In the United States, there are more unemployed than expected. Good news for the markets, starting with Wall Street which opened higher, overcoming fears stemming from the Covid recovery.

The positive reaction is not the result of sarcasm but only the result of prediction. Higher-than-expected unemployment figures may prompt the Fed to ease monetary policy tightening. The main argument of the hawks was precisely this: as long as the labor market takes precedence, the war on inflation is the priority. So keep raising the price until you hit the 5% target. Now, however, some rethinking may come given that the recruitment front is also starting to show some cracks.

The Labor Department reports that Unemployment claims came in at 225K for the week ending December 24th. That’s an increase of 9,000 from the previous week and slightly higher than analysts’ estimates of 223,000. Long-term continuing claims, which come a week after the headline figure and indicate the true number of people out of work, jumped to 1.71 million, up 41,000, to their highest level since early February. .

European stock exchanges

This push also led to the emergence of European stock exchanges. Best price list milan which earns 1.2%.It was followed by Frankfurt, which rose by 1.03%. Paris +0.97% and Madrid +0.72%. The rally in London was lower, ending at +0.22%.

in Milan The best blue chip is Saipem An increase of +4%. It is approaching the six-month highs recorded in November at €1.1570. The stock has lost 75% since the beginning of the year. +80% of the past three months puts Saipem in first place among the blue chips of FTSEMIB, which stops at +16.50%. Websim price is 1.20€.

very hot day

We reported this morning tencasta After purchasing 20% of Defense Tech Holding (an Egm listed company) at €4.9 per share. Today Tinexta gained 5.65% to 23.2 euros. The agreement provides for the possibility that in 2024 Tinexta will launch a takeover bid aimed at delisting. Also for this reason, Defense Tech Holding today gained 14.45% to 4.39 euros.

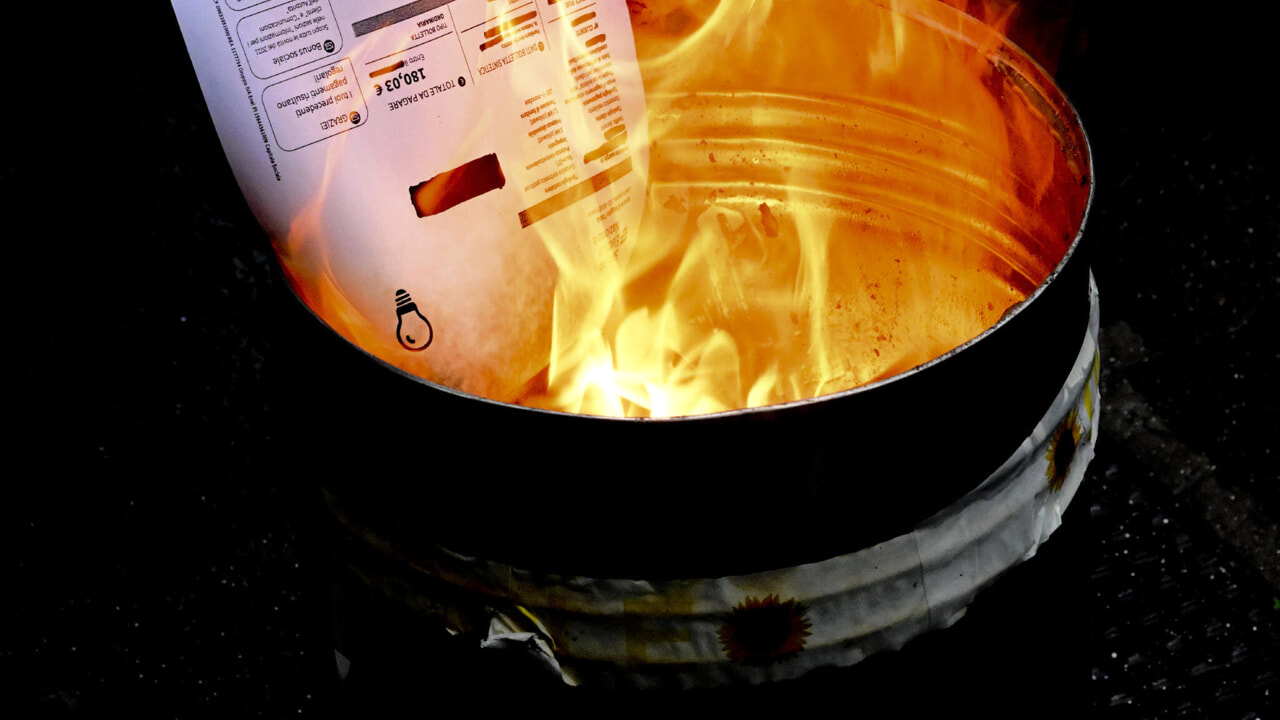

power

petroleum

Oil stocks increased in the United States, contrary to expectations. It recorded an increase of 0.718 million barrels, compared to expectations of a decrease of 0.7 million. WTI remained emphatically lower: it is now losing 1.29%, to $77.94 a barrel.

Gas

It is rebounding +4%, off the lows of the past 10 months. December shows a bold red balance sheet: -40%.

association

A positive session for government bonds. Prices were on the upswing and the Italian 10-year bond outperformed other “core” sovereigns in the Eurozone, narrowing the spread with the Bund again, finishing at 208 points from 213 yesterday. This brings the yield down to 4.53% (4.63% at the beginning and 4.64% at the end of Wednesday).

currencies

The euro rose slightly to 1.066 against the dollar.

He went

It rose 0.6% to $1,815.

“Prone to fits of apathy. Introvert. Award-winning internet evangelist. Extreme beer expert.”