Friends who invest in government bonds know very well that a new month begins BTP/BOT auction software Nice screen print. Planning is actually the first rule to follow for buying sovereign bonds from an investment perspective.

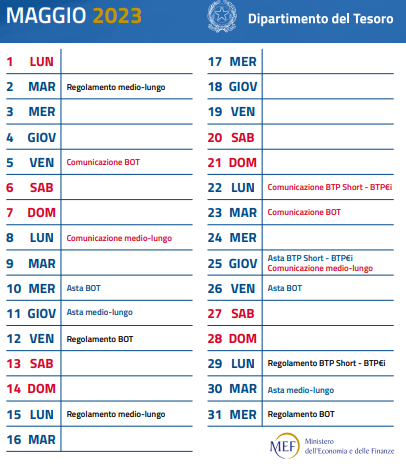

That is why, as is customary for us now, in view of the beginning of May 2023, we propose a short program of BTP / BOT auctions on the agenda.

What can be found in our document? It is not the properties of treasury bills and long-term bills that are issued. In fact, the announcement is made through a correspondence issued by the Treasury Department a few days before the auction. What can be found is a list of all the hot dates i.e. the days when the auction is scheduled and the most important days when communication by MEF is expected with the details we mentioned earlier.

Having said that, let’s get straight to the point.

BTP/BOT Auctions in May 2023: What to Expect

April is marked by a flood of emissions in the last 10 days of the month. If this happens it is because of the Easter celebrations. It may be much smaller from this point of view.

Since it’s the only holiday scheduled for May 1st (which also falls on a Monday), there won’t be any problems for anyone. More uniform spread of the bars For both types of government bonds.

So far, there are no additional placements expected (eg BTP Italia) and so the program is one of the usual five (with BTP Short – BTP€ia making a solid pair).

The fact that the entire BOT/BTP auction schedule is spread evenly throughout the month can easily be deduced just by reading the sequence below:

- May 10, 2023: First BOT Auction

- May 11, 2023: Medium and Long Term Auction

- May 25, 2023: BTP Short Auction – BTP € i

- May 26, 2023: Second BOT Auction

- May 30, 2023: Second Mid-Term Auction

In short, the timing of May appears to be more consistent than in past months, even if the usual trend of concentrating more appointments in the last week of the month remains.

BTP Auction May 2023: Details

The 2023 BTP auction calendar for May includes three dates. These are the three monthly classics that have always characterized the Treasury program.

Like every month, the dates are already known, with regard to the duration of the bond issued (and therefore the maturity date), the amount of the annual coupon, the ISIN ID and the scope of the issue, it will be necessary to wait until the specific communication from the MEF which will be taken up again on our page in the upcoming BTP auctions .

More information can be obtained already at the beginning of the month by referring to the quarterly BTP release program which refers to the second quarter of 2023. This document contains information on new BTP releases scheduled for the period between April and June as well as some reopenings on the agenda . net of positions that were already executed last month (eg the new 10-year BTP issuance in the April 27, 2023 auction), there are still a series of positions that could also be executed in May (but they are not so sure that they will be).

So here are the three scheduled dates with BTPs in May 2023.

MEF Communication History, BTP Issues and Regulations May 2023

To facilitate the development of an investment strategy by our fellow readers who typically invest in government bonds, here is our usual easy-to-consult chart. Three dates are set for each auction: the date the Treasury press release was published (most important for operational purposes!), the actual auction date and the settlement date.

The times are always the same:

- Submission of applications at auction at 11.00 on the day of placement

- Submit additional auction requests by 3:30 pm the day after the auction

- May 8, 2023: Medium and long term contact

- May 11, 2023: Medium and Long Term Auction

- April 15, 2023: Medium and long term settlement

_______________

- May 22, 2023: Short Term Connection + BTP € i

- May 25, 2023: Short-term auction + BTP € i

- May 29, 2023: Short term settlement + BTP € i

_______________

- May 25, 2023: Medium and long term contact

- May 30, 2023: Medium and Long Term Auction

- May 1, 2023: Medium and long-term settlement

The results of the auction will be announced at the end of the subscription process, and therefore between 11 and 11.30 on the day the operation is executed.

BOT Auctions May 2023: Details

Two appointments to May Treasury bill auctions as indicated by the 2023 BOT issuance calendar.

However, what the calendar does not say and which instead has become a habit on the part of the MEF is that new issuances of regular bonds are accompanied by a reopening. Bonds are already being issued (Hence BOTs have a short residual life). Even in one of the BOT auctions in April, there are 2 reopenings and 0 new releases.

This means that it is critical to refer to the details of a single transaction that will be communicated to the Treasury on the dates shown below. This information (which security ID is issued, which reopens, ISIN, duration and position range) will be reported by us on the page dedicated to the next BOT auction which we recommend saving to your favourites.

Here are the hot May dates for BOT auctions.

MEF Call Date, BOT Issues and Regulations May 2023

For each section, the connection date, auction date and settlement date are specified. Unlike BTP, there are no overruns in the next month.

- May 5, 2023: BOT call

- May 10, 2023: BOT Auction

- May 12, 2023: Organizing a BOT

_______________

- May 23, 2023: BOT call

- May 26, 2023: BOT Auction

- May 31, 2023: Organizing a BOT

Are you interested in BTPs and BOTs? Stay up-to-date with analysis and news on new issues Subscribe to our Telegram channel

May 2023 Government Bond Auctions: Are Expected Yields Still High?

In recent auctions of BTPs and BOTs, the returns have given the impression that they are in the consolidation phase. So, after sustained growth in the previous months, the trend appears to have slowed recently even in a context of high productivity.

As always, the first catalyst is the ECB’s monetary policy decisions. It is true that analysts (S&P and Goldman Sachs in this case received conflicting opinions (we talked about them in this article), however, continuing the concrete work, An important fact came out in AprilContrary to what the markets hope, there will be no mitigation in the rate of increase in the reference rates. Unlike the Fed, EuroTower will continue to raise the cost of money. According to analysts, it is reasonable that there may be increases until September and then an adjustment. However, in order to reverse monetary policy, it will be necessary to wait for the new year.

The pointers we expressed in these two posts therefore remain valid:

So the strategy always remains the same: buy now and cash in over time when the dynamics change.

And speaking of strategy, May Government Bonds begins for our readers with two analytical articles that have been very popular in recent weeks. We suggest them again:

Happy May 1 to all of our readers!

“Infuriatingly humble social media buff. Twitter advocate. Writer. Internet nerd.”