Balance transfer platform, how does it work? Providing guidelines and news assessment is the Revenue Agency’s guide updated April 2022. More details on Super Bonuses and Home Bonuses: It will be possible to view possible options based on applicable limits and conditions.

Balance transfer platform, how does it work?

To explain it isrevenue agencywith the guide updated in April 2022.

The platform welcomes various clips of Transferable tax credits To third parties, not only big reward Which house bonus Normal, but also Holiday Tax Credit and ACE Tax Credit.

To access the Balance Transfer Platform through the Reserved Area of the Revenue Agency website, both transferors and transferors must use their SPID, CIE, or CNS credentials.

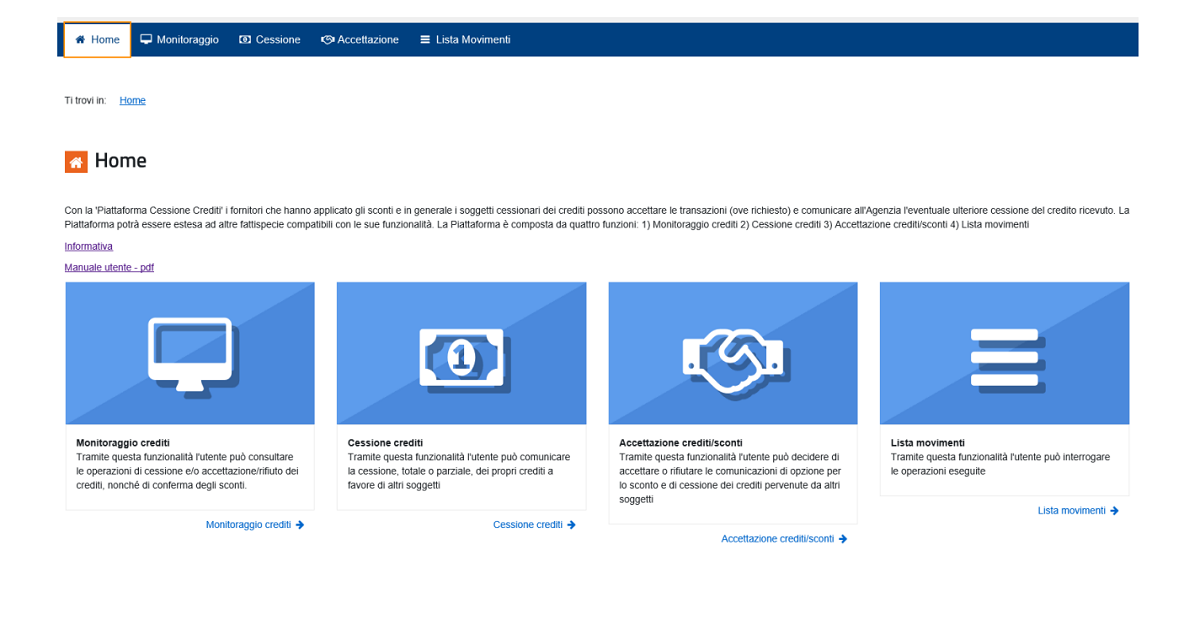

I Four jobs is expected: watchingAnd Balance TransferAnd Acceptance And Move Listpassages that characterize the exercise of options, are limited to Three conversions In accordance with the latest changes stipulated in Decree-Law No. 13/2022 and with different rules regarding assignees.

Ads which are reflected in a programwhich now collects credits based on Transfer RulesTransferable: Those transferable to any person are divided from those transferable to eligible persons only.

Balance transfer platform, how does it work? 2022 Guide from the Revenue Agency

It’s by Balance Transfer Platform fromrevenue agency This is possible Managing the different steps of tax credits Transferable to third parties, subject to the rules and restrictions currently in place.

there Instructs Updated April 2022 to evaluate the various rules envisaged and also in light of Deadline April 29 2022 To report the waiver of credit for bonuses 2021 and for the remaining installments 2020 which is good to delve into How it works Revenue agency platform.

arrive to a program Available by following the path”Services – Privileges – Balance TransferThe four available functions will be displayed on the main page: Monitoring, Assignment, Credit Acceptance and Transaction List.

The first allows you to See the brief summary From receivables received, sold and used in clearing through F24 and residual.

- Revenue Agency – Credit Transfer Platform User Guide

- Download the updated guide in April 2022

Balance transfer platform for ERA 2022: Amounts divided according to the rules of use

In the department “watching” Some of the latest innovations introduced in the context of allocating credit to build rewards find space, and according to the Revenue Agency’s Handbook, the credits are broken down into:

- Transferable balances to “anyone”that is, they have no restrictions as to the subjects that can be sold to them;

- Transferable receivables to “eligible parties”That is, it may only be sold for the benefit of:

- Banks and financial intermediaries registered in the register provided for in Chapter 106 of the Unified Banking and Credit Law, pursuant to Legislative Decree No. 385;

- companies belonging to a banking group registered in the register referred to in Article 64 of the Uniform Law referred to above;

- Insurance companies authorized to operate in Italy by Legislative Decree No. 209;

- Non-transferable creditswhich cannot be subject to further sales.

The same subdivision also distinguishes the new section assigned to it from the platform Balance Transfer. Amounts are grouped according to the rules of transportation, and the available information helps users understand what is possible Destination of transferable credits.

In the case of transfer of the possible balance exclusively to the eligible parties, the platform will verify that the token of the transferee is in the lists prepared by the Bank of Italy and IVASS. Only in the positive case will it be possible to continue the operation.

Acceptance or rejection on the balance transfer platform within five working days

Once the fields are filled out and the amount of credit to be transferred, to continue, it will be necessary to click on the button “Transfer selected credits”Confirm your desire to perform the operation. The connections made will then be summarized on a later page.

at this point The ball passes to the recipientwhich will find allotted credits on its platform, for accept or reject it After five working days (in case of transfer after the first).

In the latter case, they will return to the availability of the adapter, while in the case of acceptance they may be Also soldwithin the limits stipulated or used therein Compensation using Form F24.

The platform section related to accepting credits/discounts allows the user to view credits transferred by other topics and notifications of the discount application to the invoice as a resource.

Amounts subject to acceptance will then be charged to the tax drawer for use in it Clearing up by December 31 From the reference year regarding bonuses and home bonuses.

Balance transfer platform, in the list of limit and option movements

Further details of the changes made in the context of credit allocation are then provided in the section “Move List“through which the user can Consultation and export of contacts list who is the assignor or assignee.

In fact, among the information presented there is a special area called More conversionallowing the transferee to understand even before accepting the amounts if He’ll be able to move it further For other topics and with no restrictions.

Finally, the Revenue Agency’s guide indicates the transferability rules currently in place in the context of construction bonuses:

| It happened | young man | more actions |

|---|---|---|

| First sale or discount | The agency has been notified of the first sale or discount by February 16, 2022 | Balance can be transferred only once to any person (wild card) and then twice to “Eligible” persons |

| The agency has been notified of the first sale as of February 17, 2022 | Balance can be allocated twice for “qualified” items. | |

| The agency has informed the discount as of February 17, 2022 | Credit can be allocated once to anyone and then twice to ‘Eligible’ subjects. | |

| Subsequent sales of the first | Subsequent sales to the agency by February 16, 2022 | Balance can be transferred only once to any person (wild card) and then twice to “Eligible” persons |

| Subsequent sales to the agency by February 16, 2022 and wildcard sales to the agency by February 17, 2022 | Credit can be allocated twice to ‘Eligible’ subjects. |

The rules on which More changes to come: With the transformation of Legislative Decree No. 17/2022 A fourth allocation of credit by banks will be allowed.

Once all three transfers are completed in a controlled environment, banks will be able to choose to sell exclusively for the benefit of the people with whom they have entered into current account contractwithout the right to further carriage.

“Infuriatingly humble social media buff. Twitter advocate. Writer. Internet nerd.”