The bond in question was placed in part (per 1.73 million) with Crowdfunding campaign on the platform crowds to upstart The rest is outside the platform (see another article by BeBeez). The bond was issued exactly one year ago with a maturity date June 30, 2023 (if not listed)at a fixed annual total interest rate 6% With quarterly coupons. loan Funded investments second half of 2022 in the new investee companiesWith the aim of supporting entrepreneurs in developing initiatives.

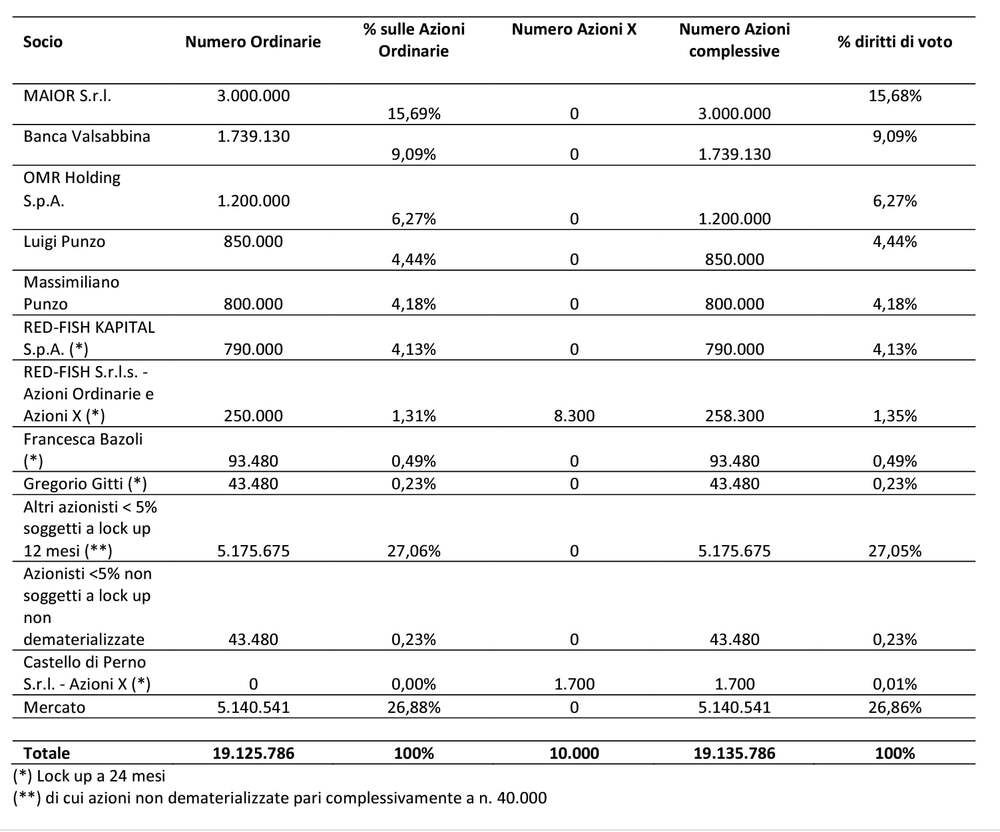

Returning to the IPO in detail, approximately 2.98 million shares have been offered, of which approximately 298 thousand are allocated to the exercise of the lump sum option, at a price of 1.50 euros per share. The admission for negotiation, as we have mentioned, also determined the conversion of the convertible note at the same price, so that the ordinary shares admitted for negotiation would therefore be about 19.4 million, of which 1.99 million resulted from the conversion of the debenture. 4.97 million of the Company’s promissory notes due in 2025 will also be listed, allocated free of charge to committed IPO shareholders and former bondholders, at a ratio of one guarantee for every common share.

In the listing process, RedFish LongTerm Capital is assisted by Mit Sim as Euronext Growth Adviser and Global Coordinator, Gitti and Partners Studio Legale Associato as Issuer Legal Adviser, by BDO Italia as Audit Firm, by LCA Studio Legal as Euronext Growth Legal Adviser and Global Coordinator, By notaries of ZNR for notarial aspects of corporate actions, by KT & Partners as provider of equity research, by Spafid as corporate service center for Monte Securities (Euronext Securities) and by CDR Communication.

founded it Paolo Pessetto And Andrea Rossotti, duringRedFish Capital Spa And RedFish srlsalong with Pazzoli and Getty families In 2020, RedFish LongTerm Capital, headquartered in Milan, specializes in the acquisition of small and medium-sized family-run Italian companies, with an EBITDA of more than 2 million and who want to follow a new stage of strong development also for acquisitions in Italy and abroad. An RFLTC acquires properties with a long-term time horizon and with a specialized transaction structure in qualified minority or, alternatively, majority transactions.

Prior to the IPO, it was the major shareholder with a 20.76% stake in RFLTC major srlan investment holding company he controls Titian Gotthard And Maria Cecato during Viribus Saba by Gotthard Titianfollowed by Valsabina Bank to 12.03%, who will dilute their shares proportionately, while remaining the main shareholders of the company even after the IPO.

Paolo Pescto, Founder and Head of RedFish LongTerm Capital commented: “We are very proud to have reached this historic milestone which we believe will allow us to reach and achieve new and important goals, also thanks to a larger vision. We would like to thank all those who believed in our project from day one, and the collaborators With the RFLTC, the investors and all relevant advisors.”

Andrea Rossotti, Founder and Managing Director of RedFish LongTerm Capital added: “Admission to Euronext Growth Milan opens the beginning of a new development path for the company. The proceeds from the listing, all in raising capital, will be used to accelerate RFLTC’s growth by investing in exciting new projects and strengthening our corporate support which we have already invested in. We are ready to seize all the new challenges and opportunities that the market can present.”

Among RFLTC’s most recent investments, we remember last April the acquisition of 100% to Moventera Ligurian company active in the market Italian Railways And European with making complex assemblies to light carpentry And pipe To announce the main programmes The high speed (See another article by Dr BeBeez).

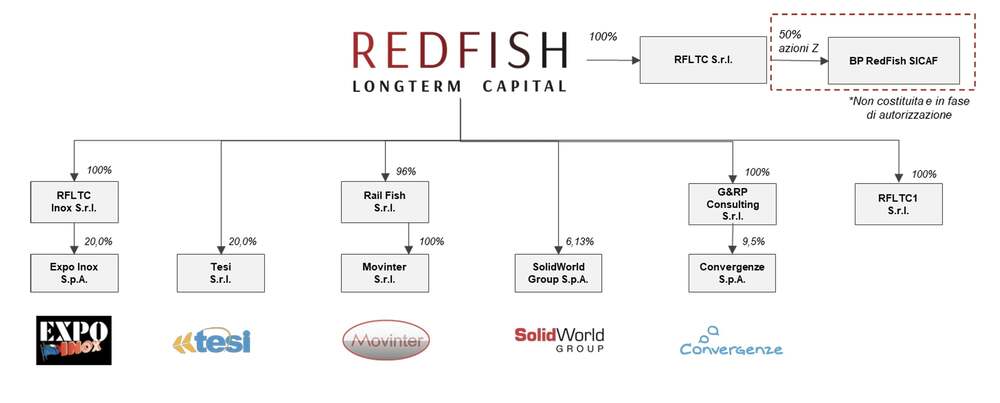

We also mention that the company through a 100% subsidiary RFLTC srlCreate and manage BP RedFish SICAFOne SICAF is approved by the Bank of Italypromoted in a joint venture with bank profile To make investments in minority stakes in companies deemed ready in a reasonable period of time to be listed on the Euronext Growth Milan market. The SICAF Fund will aim for a minimum financing of €40m, of which RFLTC and Banca Profilo have pledged €10m each by direct or indirect commitment. The return target for the entire initiative is an internal rate of return of 15%.

Finally, we remember that in addition to the RFLTC, the RedFish group also includes Innovative- RFK It is an investment vehicle dedicated to startups and innovative SMEs Euronext access On December 27, 2019 (see another article by BeBeez), after its closure in 2019 a Equity crowdfunding campaign on the CrowdFundMe platformthat he had collected 2.5 million euroswhich is equivalent to 23.5% of the capital (see another article by BeBeez); And RedFish 4 List: For pre-IPO investments in small and medium companies.

“Infuriatingly humble social media buff. Twitter advocate. Writer. Internet nerd.”